SpringFour is Integral to ESG: Financial Health is Social Impact

Financial services companies play an integral role in their customers’ lives, including outside of the deposit or loan relationship. While the financial services industry has steeped itself in the financial health space over the last decade or so, the connection between financial health programming and ESG has yet to be fully fleshed out, representing a huge opportunity to connect the dots and demonstrate the impact of such efforts. Here at SpringFour, we have seen how the partnerships that we have built have become an integral part of the impact story that our clients, including large banks, tell their stakeholders about the important work they do. Read our case study to learn more.

SpringFour Growth: Team Additions

SpringFour Growth: Team Additions

February was a big month for us here at SpringFour. SpringFour’s CEO Rochelle Gorey has spent her entire career in financial services, often from the perspective of building better policies, products and solutions that help people see a better financial life. So it was a full circle moment for her to be named a finalist for Lendit’s Fintech Woman of the Year and to share this recognition with other leading fintech leaders. This Award serves as a powerful recognition that what we are building at SpringFour matters–financial health has become a key aspect of financial services, and we are creating long-term impact in the industry. This nomination was a nod to the hard work and passion of the SpringFour team and a recognition for our passion: day in and day out, we continue to build the best financial health platform that exists.

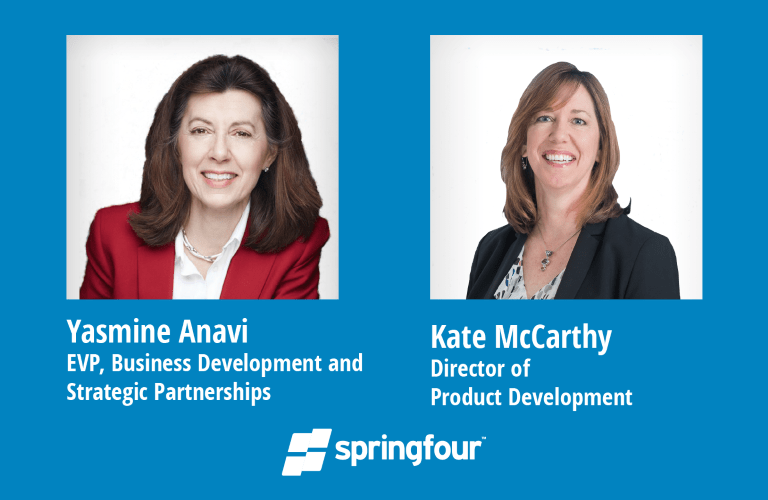

The SpringFour team is growing and in doing so will allow us to accelerate our ability to scale and create impact. Our two new hires have extensive experience in leading industry organizations and it’s a proud moment as a founder to have the ability to bring them on board. It’s been a fast start to 2022 and we’ve added more financial industry leaders to our client list, seen demand for financial health resources continue and are beginning work on important product enhancements. As always, we are thrilled to be working with you in support of the mission of promoting financial health.

Yasmine Anavi has joined SpringFour as EVP, Business Development and Strategic Partnerships. In this role, Anavi will be responsible for developing and expanding SpringFour’s strategic relationships and implementing partner programs throughout the financial services industry.

Anavi has a track record of success in risk management at top US banks. Prior to joining SpringFour, Anavi served as the Executive Vice President and Senior Credit Officer for Cards and Retail Services at Wells Fargo, where she led the credit risk organization for its credit card, co-brand, and private label portfolio. Anavi has also held Chief Credit Officer/Chief Risk Officer leadership positions at Barclays, American Express, and Citi in a number of consumer businesses, including cards, auto, home lending, student loans, installment loans, and point of sale finance.

“I’m very excited to be joining the team at SpringFour to further expand its partner programs and help even more customers on their path to financial wellness. I’m impressed by the important work SpringFour has done in this area and look forward to being part of it in the future,” said Anavi.

Moreover, Kate McCarthy has joined the SpringFour team as the Director of Product Development, working with the product team to curate and vet Financial Health Resources. She has more than 20 years of experience creating and enhancing the accountability and sustainability of non-profit, government, and corporate social impact initiatives, including most recently as the financial education program manager at Fannie Mae. She holds a Masters in Public Administration, has worked in both the public and private sectors, and is passionate about increasing connections for effective social impact.

Katy Jacob

VP of Research & Impact, SpringFour

Awards and Recognition

DRIVE IMPACT WITH US

FOLLOW US

Fintech Women of the Year Finalist

Fintech Women of the Year Finalist

SpringFour Co-Founder & CEO Rochelle Gorey has been selected as a 2022 LendIt Fintech Woman of the Year Finalist. As LendIt shares, “this award is given to the senior executive who has demonstrated outstanding leadership, integrity, performance, and a commitment to fostering gender diversity both within her company and in the industry at large.”

Katy Jacob

VP of Research & Impact, SpringFour

Awards and Recognition

DRIVE IMPACT WITH US

FOLLOW US

SpringFour Delivers Over 3.3 Million Referrals in Partnership with Financial Institutions

SpringFour Delivers Over 3.3 Million Referrals in Partnership with Financial Institutions

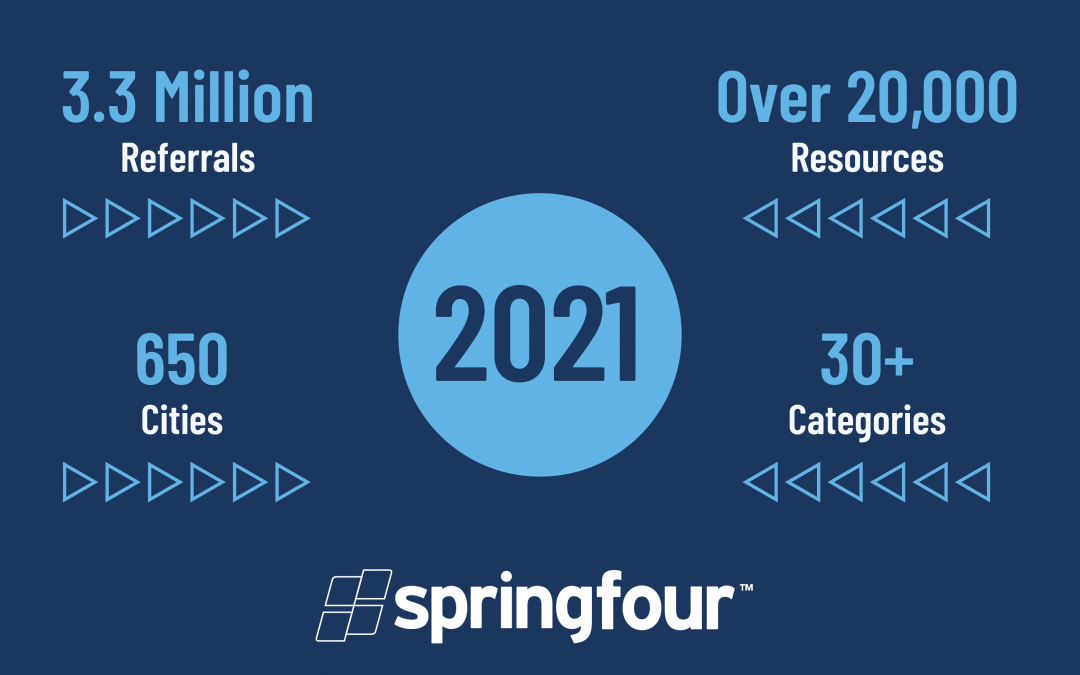

SpringFour, the only social impact fintech that helps financial institutions give customers the support they need to regain financial control, today announced in its annual impact report that it delivered more than 3.3 million financial health referrals to Americans in need in 2021.

Amid Covid and high rates of unemployment, banks, lenders, servicers, and nonprofits utilized SpringFour, giving their customers access to more than 20,000 vetted, local government, and nonprofit resources in 625 cities across the U.S. and in 30 categories. In 2021, out of all of the referrals that households received from SpringFour, almost 18% helped families afford food, 12% were employment resources, 11% were rental resources, and 10% helped Americans pay for heat and utilities.

In 2021, SpringFour deployed at new banks, lenders, and nonprofits including M&T Bank and Freedom Mortgage. To help financial institutions address their customers’ financial needs, SpringFour increased its support with 3,300 more resources available, 50 more cities covered, and more statewide resources to reach rural consumers in need.

In 2021, collection agents and customer service agents who use SpringFour to meet their customers’ needs stated the benefits of the tool in a user survey report:

- 93% say that SpringFour referrals help reduce monthly expenses.

- 90% say that SpringFour improves interactions with customers

- 89% relate that SpringFour helps with customer retention

- 86% report that SpringFour helps customers get on track with payments

“SpringFour’s metrics show that the need for financial health resources continues to be great. American households need help meeting their everyday needs, and they are turning to their financial institutions for support. At SpringFour, we are proud to be part of the solution, and we encourage financial institutions to continue prioritizing their customers’ financial health. It’s a win-win – benefitting their customers and their bottom line,” said SpringFour CEO Rochelle Gorey.

SpringFour’s additional 2021 highlights included:

- Featured in media outlets including Tearsheet, The Financial Brand, and Mortgage Professional America.

- Published thought leadership in publications that include American Banker and LendIt Fintech News.

- Co-Founder and CEO Rochelle Gorey was recognized as a LendIt Fintech Woman of the Year Finalist

- Invited to share SpringFour’s COVID-19 response, research efforts, and financial health impact in an array of forums, including those hosted by Online Lenders Alliance, Sagent, and American Bankers Association.

- Released a financial health study in partnership with Elevate, “Targeted resources can help families navigate financial insecurity: What we have learned from COVID-19.”

Katy Jacob

VP of Research & Impact, SpringFour

Awards and Recognition

DRIVE IMPACT WITH US

FOLLOW US

Recent Comments