Why we keep win-win-winning: 6 awards in less than 12 months

Why we keep win-win-winning: 6 awards in less than 12 months

Recently, we were thrilled to join so many inspiring financial health leaders at Financial Health Network’s EMERGE, the biggest finhealth event of the year! This year’s conference was a celebration of FHN’s 20th anniversary — and a reminder of the work still to be done to advance financial health. No one organization can do it all alone; strong partnerships are what make it all possible.

Fortunately, we’re making big strides. In the past twelve months alone, SpringFour has won six awards for our revolutionary work — and these have validated our mission to deliver the best-in-class financial health resources together with leading institutions.

- American Banker’s 2024 Most Influential Women in Fintech

- Inc. Magazine’s 2024 Female Founders 250

- Real Leaders 2024 Top Impact Companies

- Fintech Futures’ 2023 Woman in Technology Banking Tech Award highly commended

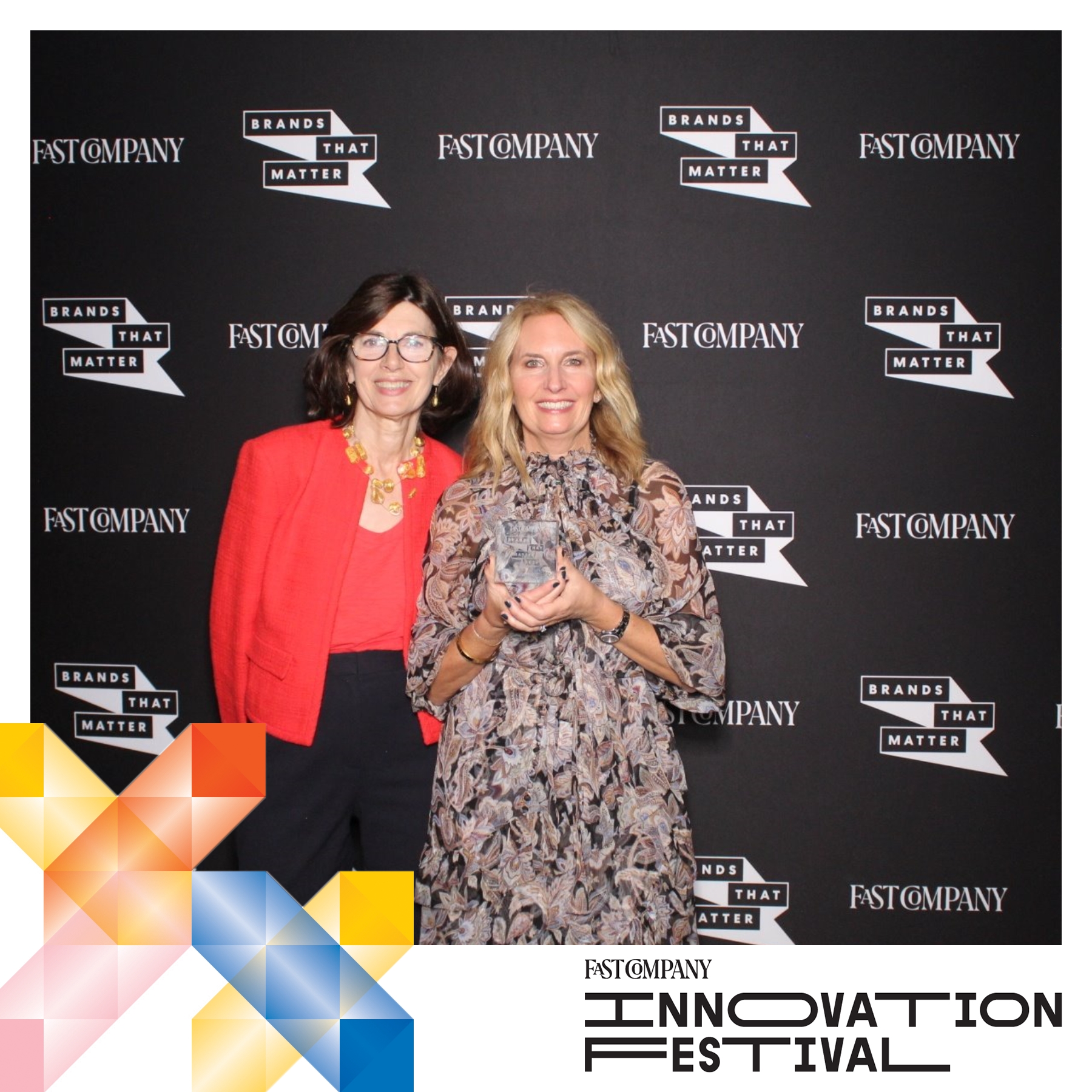

- Fast Company’s 2023 Brands That Matter

- Finovate’s 2023 Innovator of the Year winner

What Impact Means to Us

There’s a reason SpringFour is getting recognized — we’re all about real-time, tangible impact. With SpringFour’s vetted resources, individuals reduce expenses, grow their savings, and find their financial footing.

For us, impact means centering empathy, and seeing business results follow. For our clients, that has included:

- Over 5.5 million referrals to financial health resources to consumers last year

- 17-31% increase in repayment rates

- More than 5x ROI

- Millions in annualized credit loss savings

- Hearing directly from individuals about how SpringFour has helped them pay for food, save on utilities, find jobs, and more

Financial Health for the Win-Win-Win

When Founder and CEO Rochelle Nawrocki Gorey started SpringFour, “financial health” was not a term. Now, she’s been included as one of the Inc. Female Founders 250 “for demonstrating the importance of marrying social impact with fintech.”

About being included among American Banker’s 2024 Most Influential Women in Fintech, Rochelle said:

“When we started SpringFour, no one really understood what we were trying to do. It took time, intention, and integrity. We built trust and a new way of helping people and companies. Today, some of the biggest banks are our clients. Financial health is now a term we all know.”

Plus, Fast Company wrote:

“In an industry that at times has not prioritized the financial health of consumers, SpringFour is taking a different approach to banking. The company has taken on banks as clients… ensuring a customer-focused approach as well as guaranteeing stability through partnership—SpringFour currently has a 90% client retention rate.”

We’re excited for the road ahead; there’s a lot more impact to be made. One thing is clear: SpringFour stands out.

Are you ready to stand out with us? Join other top financial institutions prioritizing financial health and seeing the results with SpringFour. Connect with us at impact@springfour.com or reply to this email to get started in under 30 days.

Morgan Pierce

Impact & Communications Manager, SpringFour

Awards and Recognition

Recent Comments