SpringFour Launches Small Business Financial Support, Partners with Accion Opportunity Fund

SpringFour Delivers Almost 3.3 Million Financial Health Referrals to Americans in Need

SpringFour Delivers Almost 3.3 Million Financial Health Referrals to Americans in Need

CHICAGO, Feb. 2, 2021 –- SpringFour, the only social impact fintech that helps financial institutions give customers the support they need to regain financial control, today announced that it delivered almost 3.3 million financial health referrals to Americans in need in 2020. Banks, lenders, and nonprofits utilized the cloud-based tool as part of their COVID-19 relief strategy, giving their customers access to more than 20,000 vetted, local government, and nonprofit resources in 575 cities across the U.S. and in 32 categories, including financial assistance, food assistance, employment services, prescription savings, and home repair.

According to SpringFour’s 2020 Survey of Financial Health, created in partnership with Competiscan, 83% of lower-to-middle income households stated that they trust banks as a source of financial guidance, support, and resources.

To help financial institutions address their customers’ pressing financial needs, SpringFour increased its support with 37% more resources available and 21% more cities covered, and increased its subscribers by 43%, which included 44% more banking and lending clients including Avant, Elevate, Enova, and two of the top 10 U.S. banks and others, and 25% more nonprofit clients. The company delivered 200% more referrals than it did in 2019. Since its inception in 2005, SpringFour has delivered more than 10 million referrals to customers.

In 2020, SpringFour users stated the benefits of the tool in a user survey report:

- 98% say SpringFour is an important part of their COVID-19 relief strategy.

- 97% say SpringFour allows them to provide better customer experiences.

- 91% of users say that SpringFour referrals help reduce expenses.

- 86% agree that SpringFour helps get their customers back on track with payments.

“2020 was a tough and challenging year for all of us and we were proud to be a core part of institutions’ COVID response. As an industry, we have seen that helping people isn’t just a nice thing to do. It’s the right thing to do. And when we do this, we can see the business impact.

SpringFour remains committed to transforming the way our industry assists those experiencing financial challenges,” said SpringFour CEO Rochelle Gorey.

SpringFour’s Additional 2020 Highlights Included:

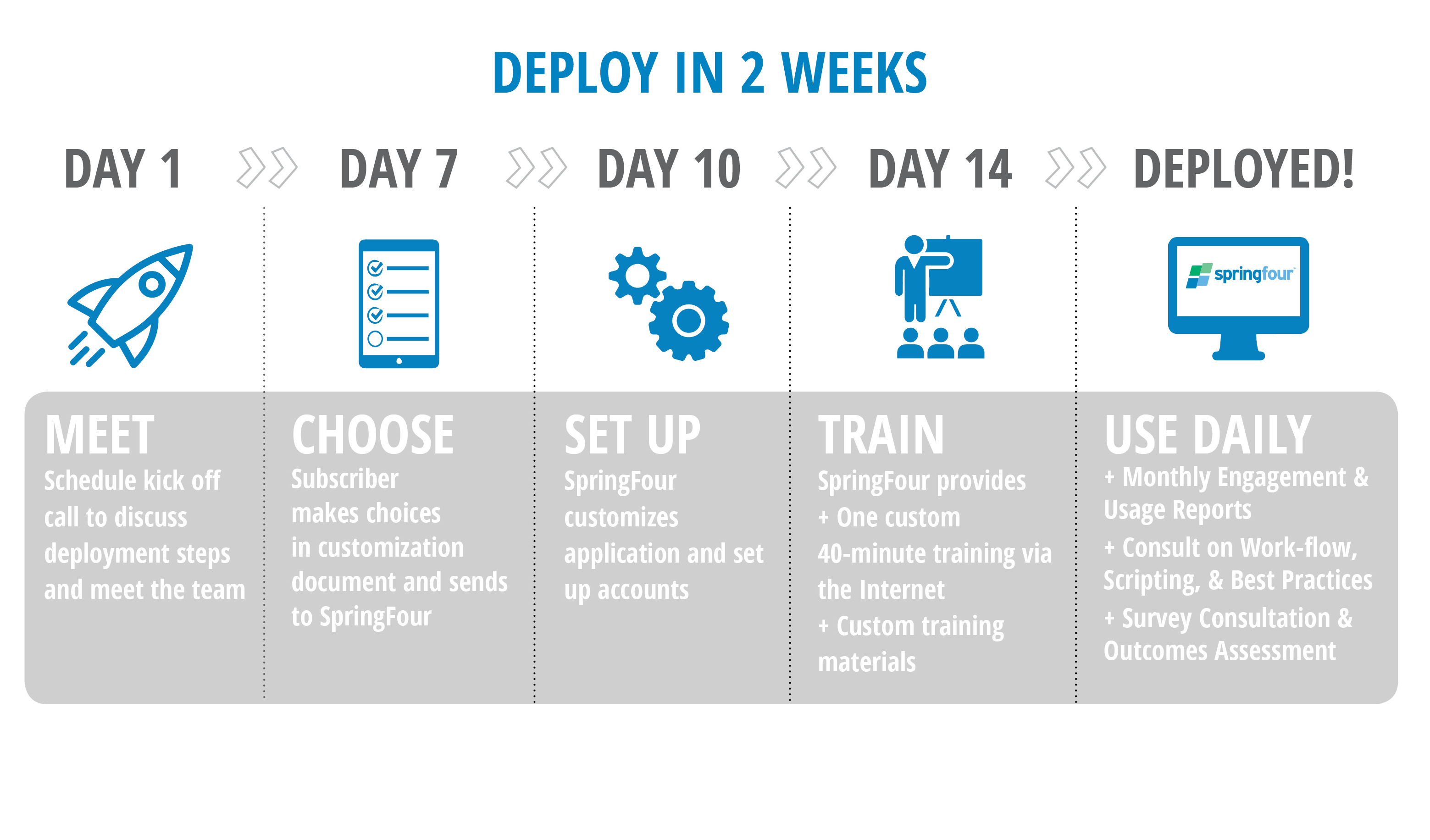

- Deployment time reduced from 30 days to 15 days

- Access to increased statewide resources to reach rural consumers in need

- Featured in mainstream and financial media outlets including Forbes (Chicago Fintech Links Lender Web Sites To Provide Vetted Help For Borrowers) and American Banker (Wellness tool from BMO Harris partner finds following with bank’s customers)

- Recognized as one of Chicago Inno’s 21 Chicago Startups to Watch in 2021

- Invited to share our COVID-19 response, research efforts, and financial health impact in an array of forums including Financial Health Network Member Summit, IPA, and the Corporate Innovation Summit.

- Released financial health report in partnership with Competiscan, “How Has COVID-19 Impacted Low- and Moderate-Income Households? A SpringFour Survey of Financial Health”

Learn More

View SpringFour’s 2020 Annual Report here.

About SpringFour

SpringFour is the only Certified B, social impact fintech company that helps financial services institutions limit risk by empowering improved payment performance and increased customer engagement. Trusted by BMO Harris Financial Group, Beneficial State Bank, Oportun, Elevate, Enova, Avant, OppLoans, and more, SpringFour’s suite of financial health cloud-based solutions for financial institutions provides vetted financial resources to millions of customers and enables them to meet financial objectives, reduce household expenses, and avoid payment delinquencies. More than 95% of financial institutions report that their customers experienced increased affinity for their brands after receiving a referral from SpringFour. To learn how SpringFour can benefit your financial institution, visit springfour.com.

Media Contact:

Rachel Sales

Enunciate

rachel@enunciate.xyz

347.601.5350

Katy Jacob

VP of Research & Impact, SpringFour

Awards and Recognition

DRIVE IMPACT WITH US

FOLLOW US

SpringFour Partners with Enova to Help Customers Save and Move Forward

SpringFour Partners with Enova to Help Customers Save and Move Forward

At SpringFour, we believe it is essential to recognize the many ways in which our subscribers work to help their customers achieve financial wellness. Since founding our company, our intent was to bring an innovative solution to the table to assist lenders when borrowers were experiencing payment challenges. It’s been exciting to see lenders embrace partnerships that seek to better understand the root cause behind their customers’ financial challenges and adopt the technology that allows them to connect their customers with vetted resources to help resolve the issue creating the payment challenge. SpringFour is proud to be the leading provider for the financial industry that offers vetted financial health solutions for its customers on an entirely cloud-based platform. Throughout the current crisis, we have seen our partners working hard to find unique solutions that can assist their customers. One of the many great examples that highlight this work is SpringFour’s partnership with Enova.

Enova is a state-licensed fintech lender headquartered in Chicago whose simple online application process has helped more than 5 million hardworking people get access to fast, trustworthy credit. Enova and SpringFour began to explore a partnership in October of 2019. As the COVID-19 pandemic intensified in early 2020, Enova wanted to implement resources for customers who might be struggling with the economic impacts of the virus. In addition to finding a credit plan that works best for each customer, Enova knew SpringFour would be an excellent tool for continuing the conversation and providing customers with free and effective solutions. By the spring of 2020, Enova was offering SpringFour resources through its CashNetUSA and NetCredit brands. By partnering with SpringFour, Enova now provides its customers with local resources that help them save on utilities, food, childcare, and more through COVID-19 and beyond. Within the first three months of partnership, Enova customers accessed more than 65,000 SpringFour referrals.

“At Enova, Customer First has always been one of our core values. Throughout the COVID crisis, we’ve worked with our customers to expand our flexible payment options and provide our customers with resources to navigate heightened financial insecurity. As part of these efforts, we were thrilled to offer our customers access to SpringFour’s platform of trusted, local resources to better help them stay on track financially through COVID and beyond.”

– Kelly Jordan, Head of Consumer & SMB Marketing, Enova

Since the start of the partnership, Enova customers have been most interested in finding ways to save on expenses such as utilities, food, and healthcare, as well as finding employment. This trend directly correlates with what SpringFour is seeing from an overall need perspective during COVID-19: families need help accessing basic necessities, and they need that help today. We are proud to help Enova meet its customers’ needs. When lenders think outside the box and provide financial resources that can help get their customers back on track, the impact is powerful — for the company and the consumer.

“We are all in this together, and working with Enova is a powerful example of how we can achieve more when we join forces. Helping people in need has always been the mission of SpringFour, and now with the pandemic, we must do more and look to partnerships to scale and expand impact.”

– Rochelle Nawrocki Gorey, CEO & Co-Founder, SpringFour

Rochelle Nawrocki Gorey

Co-Founder & CEO, SpringFour

Awards and Recognition

DRIVE IMPACT WITH US

FOLLOW US

How Lenders Are Empowering Their Employees to Help Their Customers Repay Loans

How Lenders Are Empowering Their Employees to Help Their Customers Repay Loans

The Challenge

No financial institution wants to have to give its customers bad news–especially in a time like this, when so many are experiencing financial hardship due to the COVID-19 pandemic. When customers are late making a payment or are at risk of default, that initial communication about the problem is vital in shaping the ongoing relationship and outcome with the customer. Will the person on the other end of the line or receiving the notification feel angry and embarrassed? Or will the person feel supported and see their lender as their partner in getting through this challenge? Forward-thinking companies are looking for ways to help turn a negative experience into a more positive exchange during this trying time–but they often don’t have the right resources at their fingertips.

The Solution

Enter SpringFour. We can connect your employees to over 15,500 resources in 25 categories, including more than 3,000 COVID-19 specific resources that are searchable throughout 475 markets in all 50 states. These resources are updated in real-time by a dedicated data team that personally vets each resource for: reputation; quality, availability of funds; capacity; and more.

SpringFour can help you connect to your customers and enable your employees to feel that they are providing a value-added service that no other lender can offer.

According to Ben Schack at BMO Harris Bank, one of SpringFour’s clients: “We fairly routinely have instances where a customer comes back to us after receiving the referrals and says they have never had a financial institution try to help them in that way.”

The Results

In the past two months, SpringFour has partnered with a variety of institutions looking for a partner to help them help their customers through the pandemic. The feedback we have received from the more than 4,000 agents who have used SpringFour’s services speaks for itself:

– 98% of agents felt SpringFour allowed them to provide better customer service

– 90% of users believe customers feel more positively about their company after receiving SpringFour referrals

As a recent case study of our partnership with BMO Harris shows:

– 86% of BMO staff using SpringFour said the service made them feel better about their work

– 73% of BMO staff using SpringFour said that the service improves the bank’s image in the eyes of customers

BMO Harris agents report that once receiving SpringFour referrals, customers leave collections calls feeling like their bank is there to offer real solutions and help. This has resulted in a better overall customer experience for the borrower.

“Offering SpringFour has opened up communication between our agents and customers. The application is extremely easy to use which allows my agents to move through their calls.”

– Jennifer Mota, Sr. Manager, U.S. Collections Call Center

Customers are directly expressing their appreciation for SpringFour’s services. Take, for example, the experience of LendUp: LendUp’s customers that used SpringFour were seven times more likely than not to say SpringFour made them feel more positive about LendUp:

“I have been so impressed with your business protocol, that I would very much like an opportunity to come out to your headquarters and meet and thank as many as your employees as possible, for the positive impact they have had on me and I am sure many others. Thank you for all of your patience, understanding and personal consideration regarding my financial situation.”

– Richard H, LendUp Customer

Helping your customers weather this financial storm is a necessity that should be a top priority. We are here to be your partner in financial wellness. For more information on how you can work with SpringFour, contact us.

Katy Jacob

VP of Research & Impact, SpringFour

Awards and Recognition

DRIVE IMPACT WITH US

FOLLOW US

Get Help for Families Struggling Post-COVID in Record Time through SpringFour

Get Help for Families Struggling Post-COVID in Record Time through SpringFour

The Challenge

Since the arrival of the COVID pandemic, it has become clearer than ever before that many American households are living precarious financial lives. While this was true before the pandemic, these struggles are now exacerbated by historically high unemployment rates, food insecurity, and a decreased ability for individuals to band together with family and friends to overcome hardship.

Now more than ever, people need access to appropriate resources to help them through this crisis–and they need those resources right now.

The Solution

SpringFour believes that when consumers can’t pay a bill or are living paycheck to paycheck,

they need direction to local resources that can help. We provide over 15,000 resources in 25 categories, including more than 2,500 COVID-specific resources, that are searchable throughout 475 markets in all 50 states. These resources are updated in real-time by a dedicated data team that personally vets each resource for: reputation; quality, availability of funds; capacity; and more.

SpringFour offers two solutions: S4Pro and S4Direct. S4Pro allows you to provide access to those 15,000 resources to your collections agents, counselors, and other frontline staff. S4Direct enables you to provide resources direct to consumer through SpringFour’s cloud-based portal.

And most importantly–you can be up and running with SpringFour solutions to customers in need in less than two weeks. Time is of the essence for financially strapped families right now, and SpringFour offers one of the simplest and fastest solutions available. Access to resources is no longer a “nice to have” for your company–millions of Americans need help right now, and SpringFour is your partner in financial wellness.

The Results

This quick deployment of less than two weeks is simple and low-risk for your company as well. Without requiring access to sensitive customer data, SpringFour represents a much different type of partnership when compared to other fintech providers. In addition, SpringFour does not require direct integration. Our data team utilizes a best-in-class data integrity process to ensure that all of the information your customers access through SpringFour is fully vetted and accurate. All of these factors make deployment expedient and present an extremely low-risk proposition for our clients.

“Our customers are utilizing SpringFour cloud-based applications that are easy to

deploy, are user friendly; and have resource information that’s verified for data integrity.”

– Damian Fluder, Business Unit Compliance Officer, US Collections, BMO Harris Bank

Take for example SpringFour’s partnership with BMO-Harris. SpringFour worked with senior leaders in BMO’s Risk and Compliance departments to secure approval for a pilot that would allow BMO Harris to test SpringFour within a small portion of its overall loan portfolio. A key component to success was the ability to engage with senior members on both teams so that they had a solid understanding of SpringFour’s technology, track record, and data. We went to market in under 45 days, and to date, BMO has helped 160,000 customers access resources through SpringFour. You can read more about this partnership in our case study or in this American Banker article highlighting the SpringFour/BMO-Harris partnership.

As you grapple with ways to help your customers during the COVID crisis, SpringFour can help–and can help fast. For more information, please reach out to us.

Katy Jacob

VP of Research & Impact, SpringFour

Awards and Recognition

Recent Comments