Fast Company Names SpringFour a 2023 Brand that Matters

Fast Company Names SpringFour a 2023 Brand that Matters

Extraordinary news: SpringFour has been named one of Fast Company’s 2023 Brands That Matter.

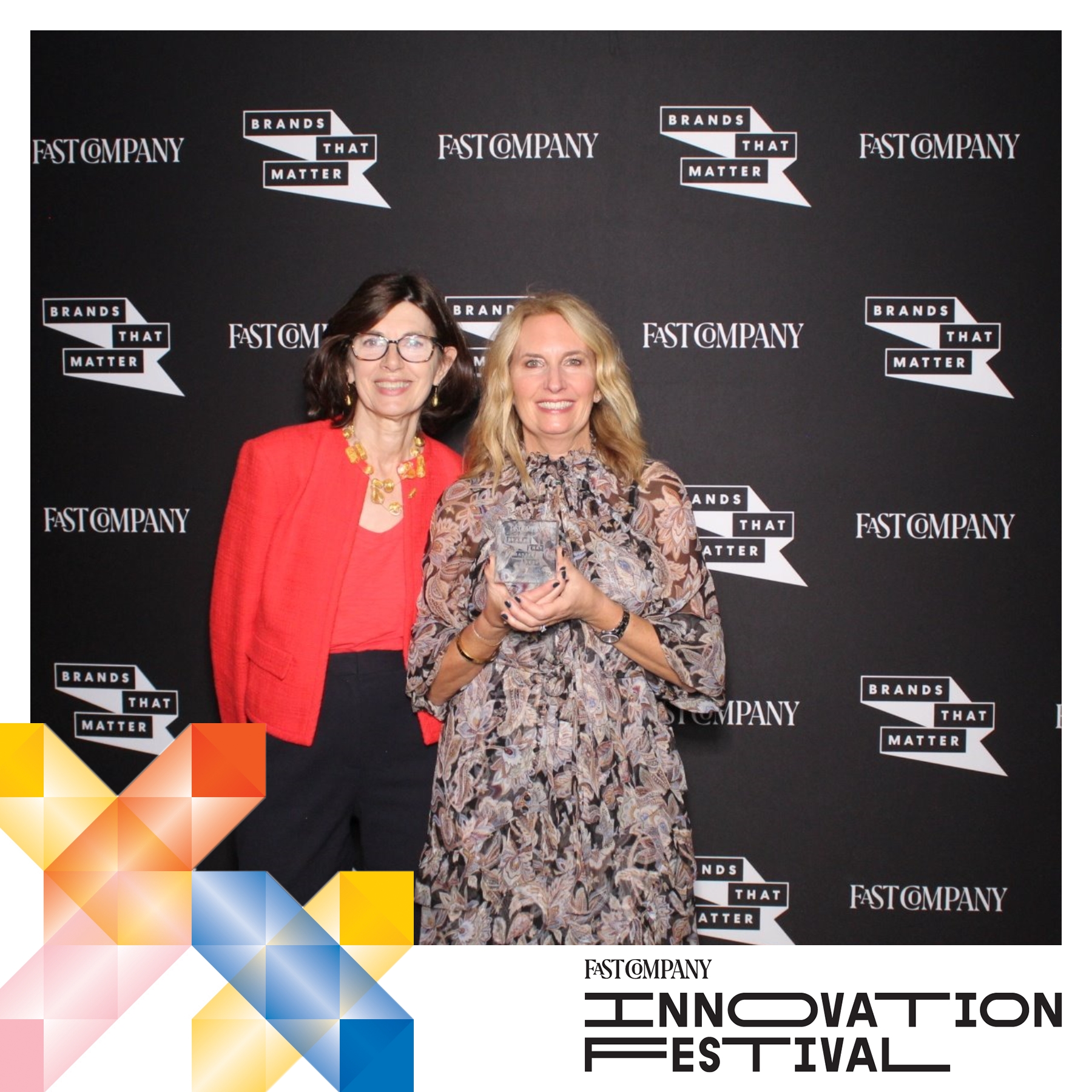

The SpringFour team is honored to accept this award from an industry leader like Fast Company, and it was so exciting to celebrate this recognition alongside other prestigious winners at the Fast Company Innovation Festival held in New York City in September.

SpringFour is one of three winners in the finance category, winning alongside Morgan Stanley and Golden 1 Credit Union, and Fast Company writes, “You can bank on these three brands when it comes to financial health.”

We are proud that we have, as Fast Company puts it, “built cultural relevance and impact through compelling branding and efforts” with our empathy-first approach and impact.

SpringFour team members Rochelle Gorey, CEO & Founder, and Yasmine Anavi, EVP of Business Development & Strategic Partnerships, accept SpringFour’s Brands that Matter award during Fast Company’s Innovation Festival in New York City

A small team with major impact

With Brands that Matter, Fast Company recognizes SpringFour and other brands that inspire individuals and organizations to care and get involved in making the world a better place.

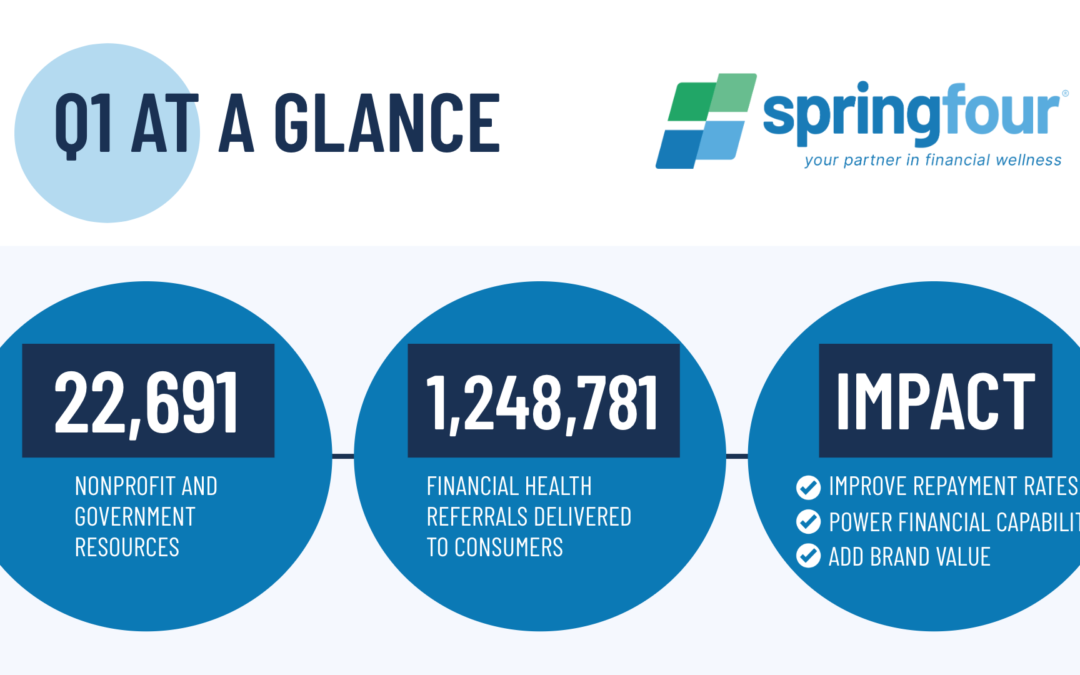

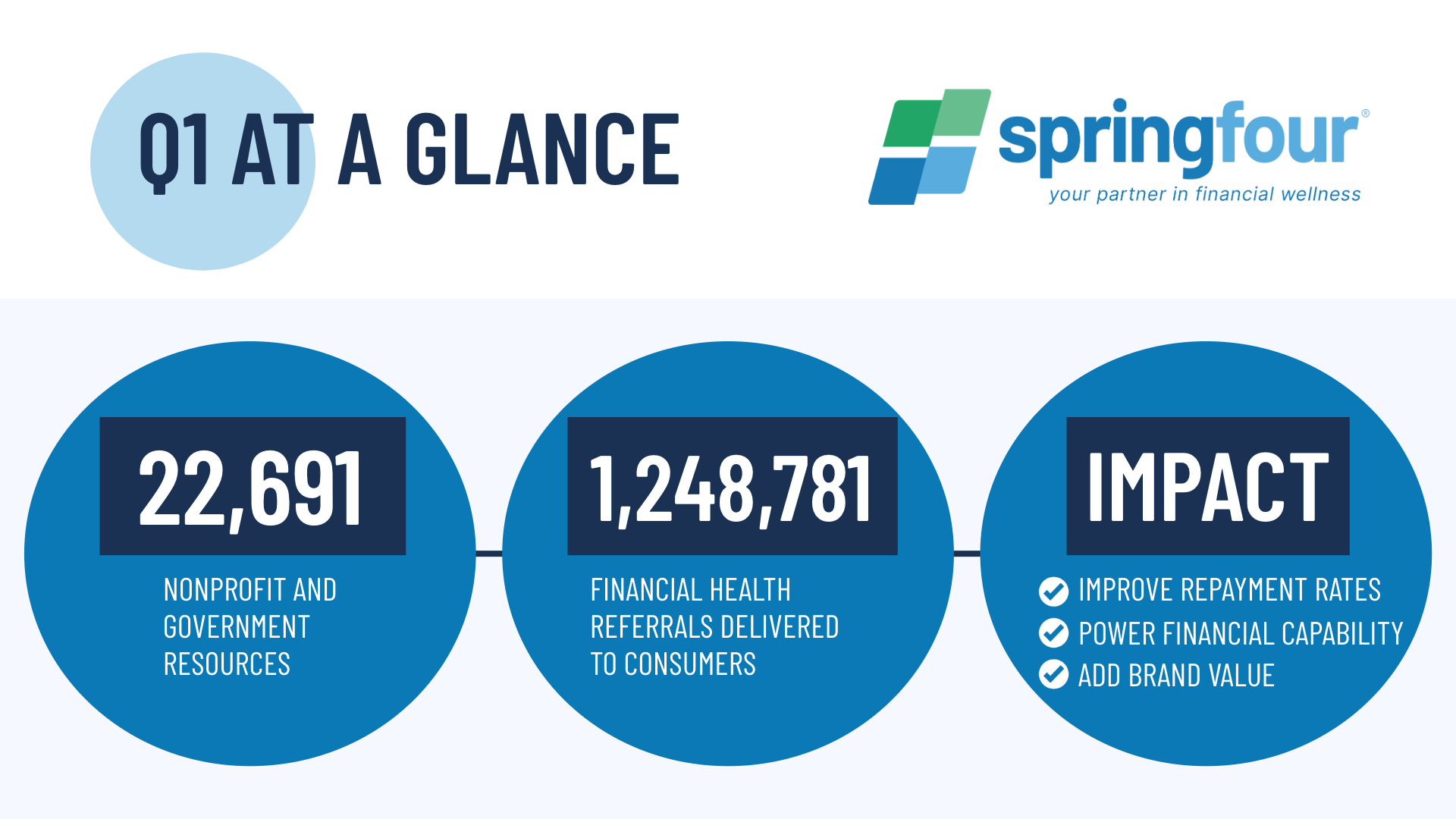

It’s vital to note that SpringFour is a small team that is making a big impact for millions of households and the leading organizations that serve them. This recognition means the world to us because it proves the following: organizations understand that an empathy-first business is the right way to do business.

We are changing the way organizations respond to people experiencing financial hardship — improving customers’ financial health, while increasing companies’ bottom line.

The demand is there

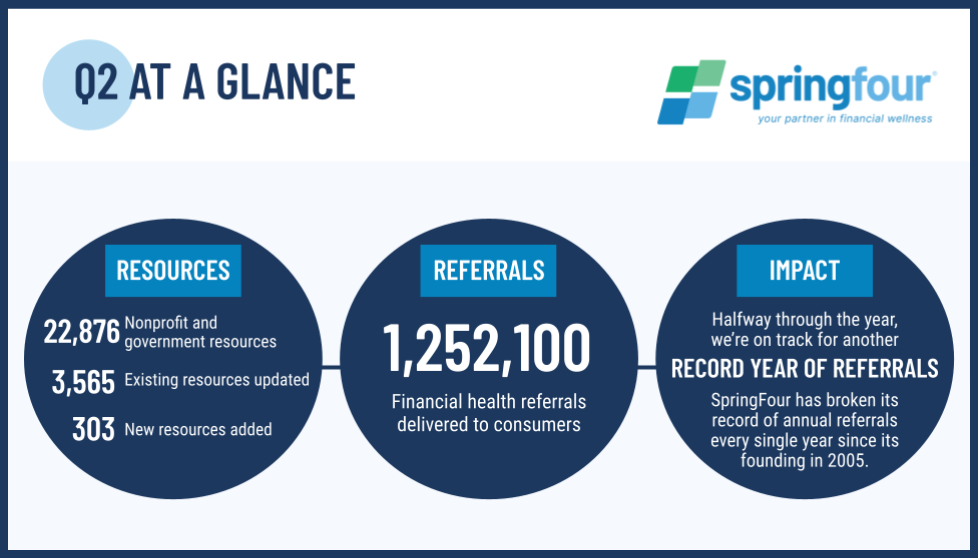

This year, we are on track to deliver 5 million financial health referrals – more referrals in one year than ever before. The demand is there — and we are proud to meet it in partnership with banks, credit unions, fintech lenders, servicers, employers, nonprofits, and more. Our innovative and effective suite of financial health solutions empowers employees, increases repayments, improves customer experience, and boosts brand loyalty.

But most importantly of all, because of SpringFour, millions of families can find their financial footing amid the ups and downs of life.

This is a proud moment for the SpringFour team – and for you, our partners, without whom we could not have achieved this milestone.

We invite you to read more about our win here, and encourage you to share the news with your network.

If you are not yet delivering real-time financial health resources with your SpringFour like leading brands, now is the time. Connect with us at impact@springfour.com to get started.

Morgan Pierce

Impact and Communications Manager

Awards and Recognition

Recent Comments