How we’re here for you and your customers — as always

How we’re here for you and your customers — as always

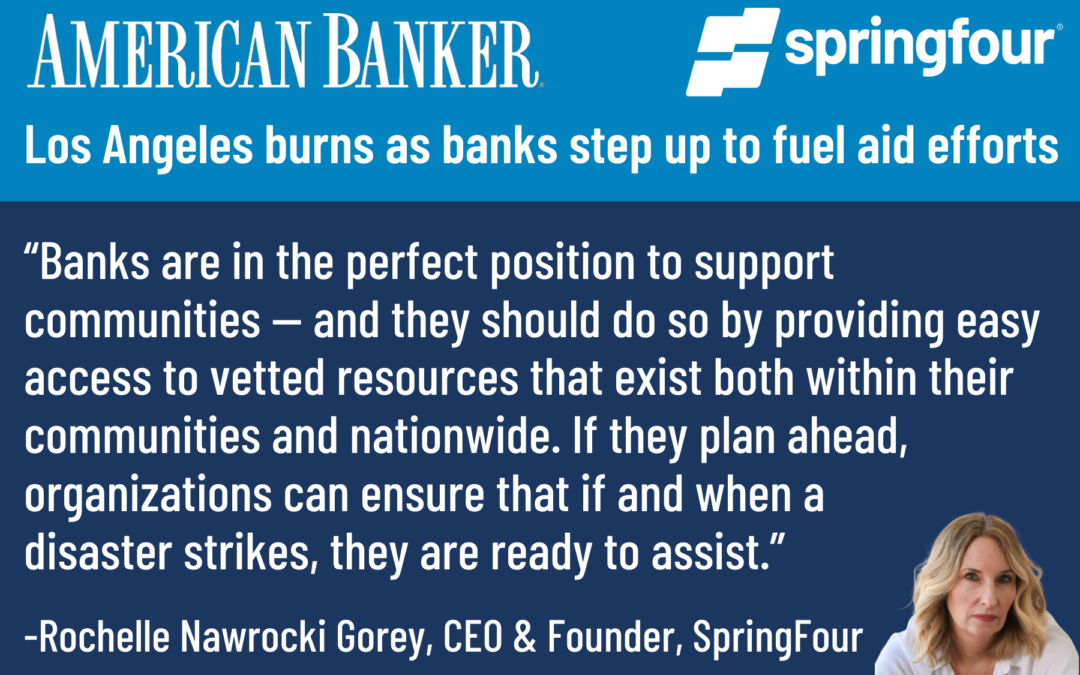

Note from Our CEO & Founder

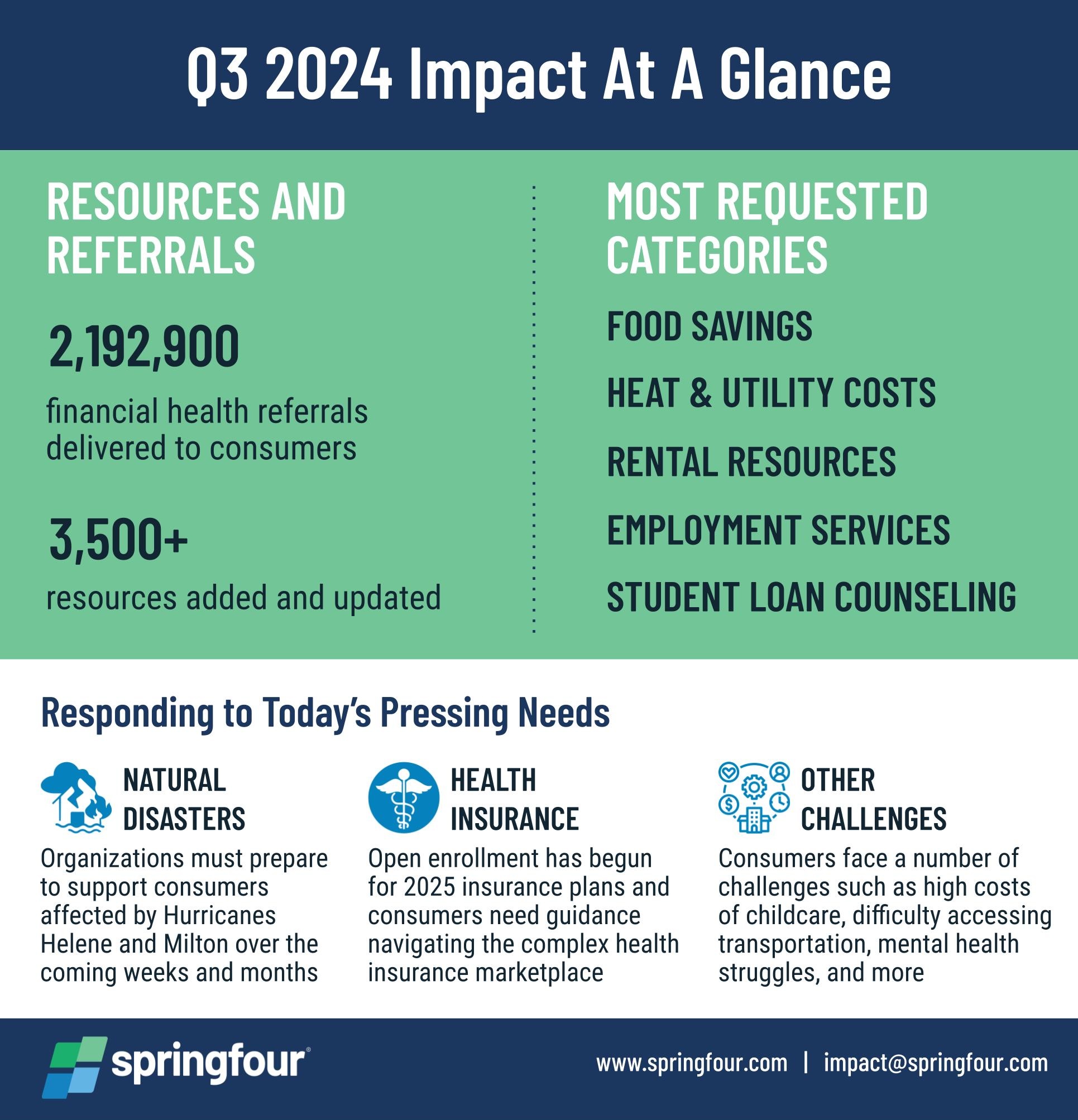

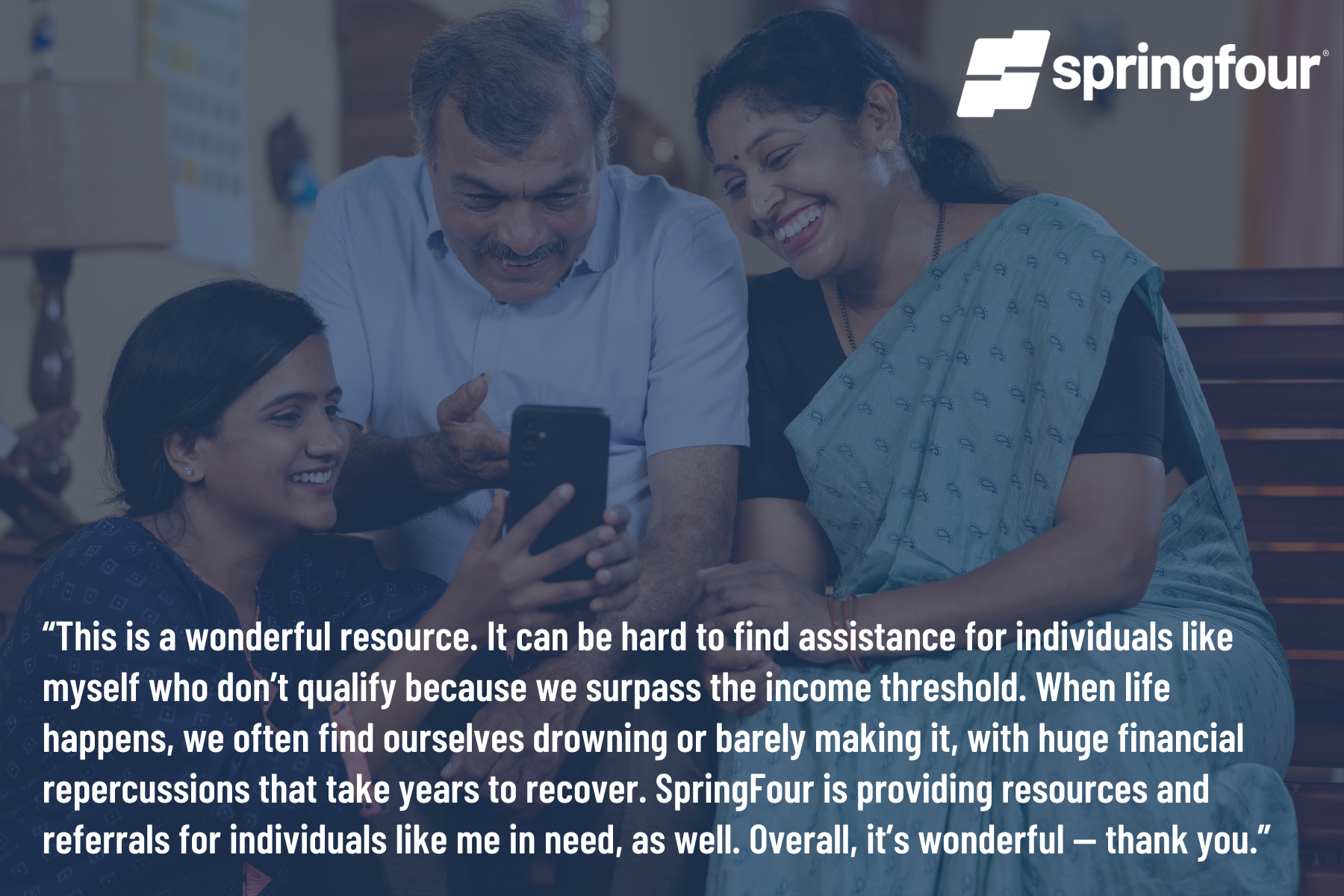

We built SpringFour to connect people with vetted financial health resources when they need them most. Today, with rising costs, policy changes, and natural disasters, uncertainty is everywhere — and we’re here to help.

Our hearts go out to all those impacted by recent events. In times like these, access to reliable financial health resources is more critical than ever.

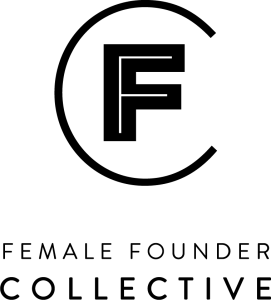

That’s why our team continuously vets and updates thousands of nonprofit and government resources, ensuring your customers always have access to trustworthy financial support. From disaster relief to everyday financial challenges like food savings, rental resources, prescription savings, and more, we make it easy for the financial services industry, nonprofits, employers, and more to provide real solutions, fast.

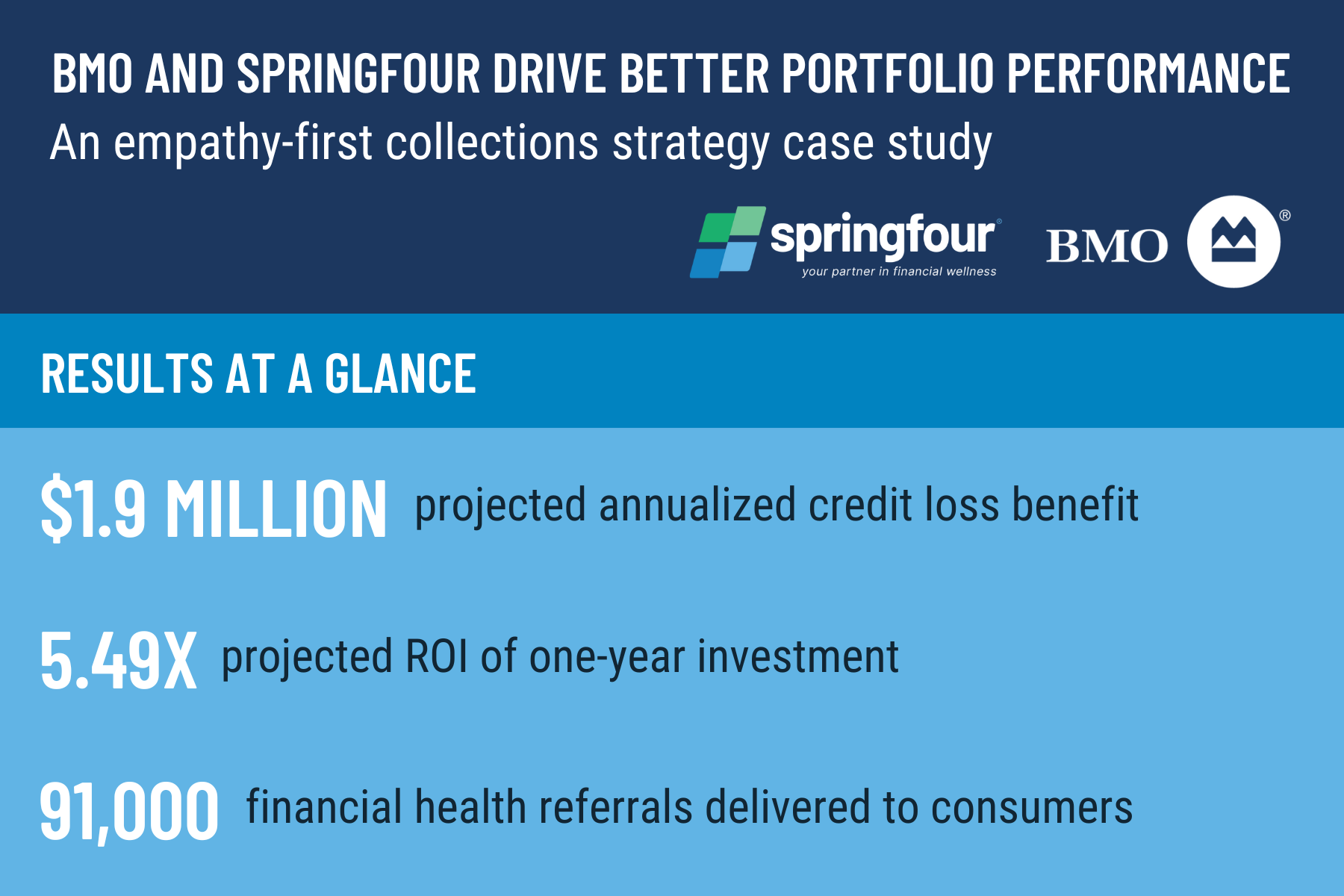

Best of all, providing this support delivers win-win results both for consumers and for our clients — who see greater engagement and trust by customers, increased repayments, high ROI, and more.

Now is the time to let your customers know that help is available. Let’s work together to get your customers the support they need.

- Not yet offering SpringFour? Reach out to sales@springfour.com to schedule a demo and get started.

- Already delivering SpringFour? Reach out to impact@springfour.com to update your categories and deliver support for the areas of your customers’ financial health that are needed most.

Thank you for your partnership,

![]()

Rochelle Nawrocki Gorey

CEO & Founder, SpringFour

There are many ways to bolster financial health strategies with SpringFour, including:

☑️ Provide immediate access to SpringFour’s 25,000+ regularly reviewed and updated financial health resources including local, statewide, and national nonprofit and government relief programs.

☑️ Choose from 25+ categories to deliver financial health resources that support your customers including food savings, home repair, mental health services, heat & utilities, transportation, employment services, and more.

☑️ Create a relief landing page to keep specific resources available to support consumers year-round, helping them know where to access trustworthy resources on their own time.

☑️ Strengthen customer communications around specific issues by sharing empathy-driven messages offering support and pointing people to valuable resources that can improve their financial situation.

☑️ Quantify impact and share successes with consumers and stakeholders on social media; on your organization’s website; in annual, ESG, and impact reporting; and more.

Awards and Recognition

Recent Comments