What consumers want isn’t a budgeting tool — it’s an immediate path toward financial health

What consumers want isn’t a budgeting tool — it’s an immediate path toward financial health

When I read the press release on J.D. Power’s latest Financial Health and Advice Satisfaction Study, one line stood out to me more than any other:

“Buzzwords like personalization and tailored advice get thrown around quite a bit among banking professionals, but this is much bigger than a marketing exercise.”

I couldn’t agree more.

At SpringFour, we’ve been building solutions around this exact idea for nearly two decades. And we’ve always known the real work is about impact.

Real financial health requires more than advice. It requires access. When someone’s struggling to pay bills, afford child care, or keep up with medical expenses, suggesting they stick to a budget or start saving for a long-term goal doesn’t help unless we’re also pointing them toward ways to actually do that. That’s where SpringFour comes in.

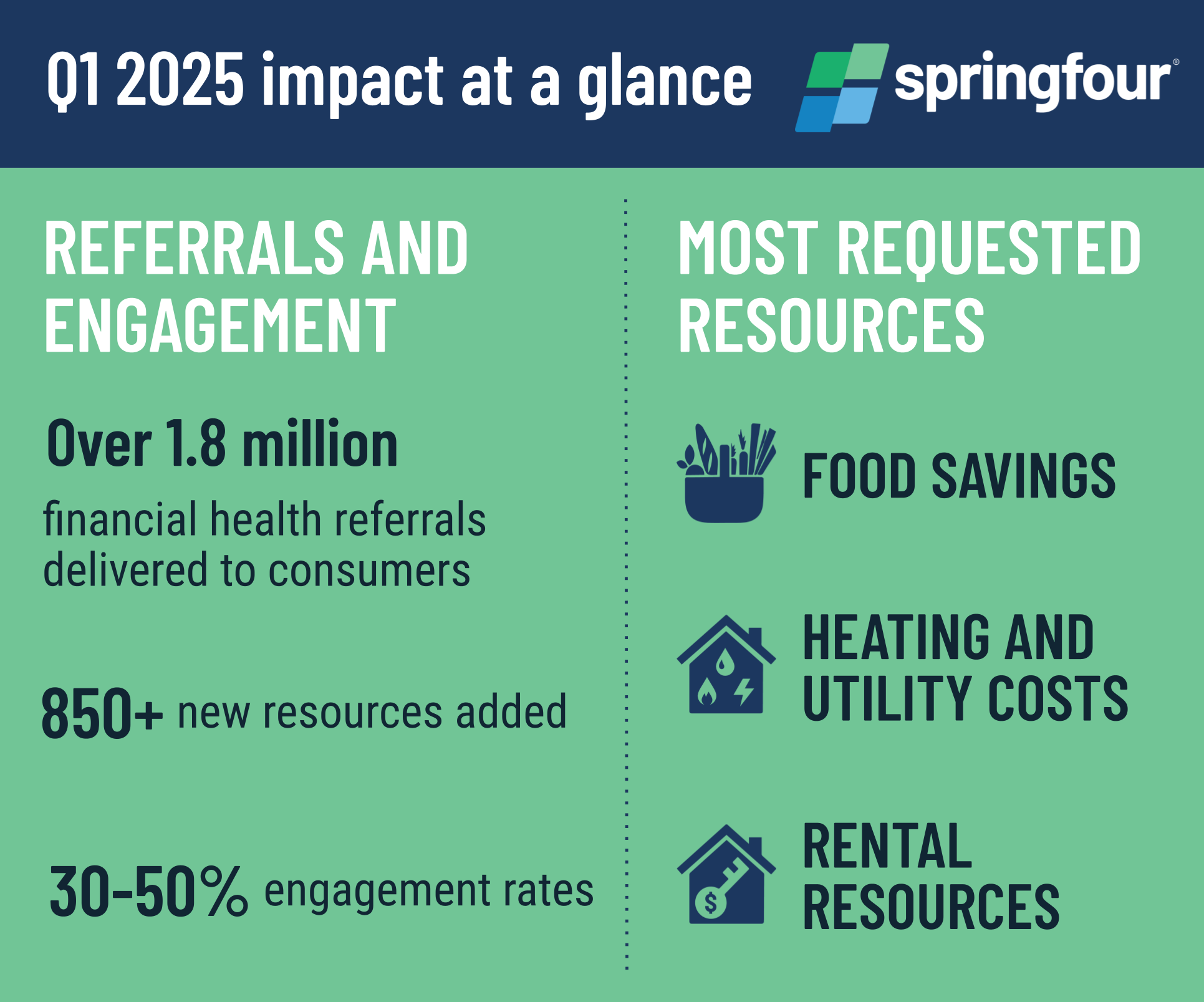

We connect people to trusted, nonprofit and government resources that help lower household expenses in areas like food, utilities, employment, and healthcare. It’s not theoretical — it’s immediate, actionable support, embedded into the banks and lenders they already trust. In 2024 alone, we delivered more than 8.5 million financial health referrals.

So when J.D. Power reports that 43% of U.S. retail bank customers are now considered financially vulnerable, it confirms what we already know: people are looking for more than tips; they’re looking for tools.

They want tangible, actionable support. And they’re not just open to receiving it from their banks — they expect it. And that is great news for us in this industry — because this is relatively easy to solve.

The study found that 26% of all bank customers — and 36% of those under 40 — are actively seeking financial guidance. Yet ,one in five customers who researched budget management tools never ended up using them.

Why not? Perhaps the tools weren’t useful or relevant.

Awareness does not equal access and delivering educational resources is not sufficient. If banks truly want to help their customers improve their financial health, then they need to move beyond sharing advice like “budget and save.” They need to provide people with vetted, accessible ways to save by helping to reduce household expenses or access programs that can assist. Available technology solutions exist to do so and are built to easily scale.

Many banks are ahead of the curve here. Capital One, Fifth Third, M&T Bank, and others that partner with SpringFour are embedding vetted financial health tools into their digital platforms. And the results speak for themselves — with increased engagement, improved payment rates, and stronger customer trust.

Consumers are struggling because they’re stuck — and they’re telling us, clearly, that they want us to help.

So here’s my question: if we know what works, and we have the tools, what are we waiting for?

Rochelle Nawrocki Gorey

Founder & CEO, SpringFour

Awards and Recognition

Recent Comments