Rochelle Gorey on SpringFour Being Selected for The Financial Health Network’s Leaders Program

Rochelle Gorey on SpringFour Being Selected for The Financial Health Network’s Leaders Program

Rochelle, can you tell me about SpringFour’s relationship with the Financial Health Network?

I attended my first EMERGE Forum in Los Angeles in 2015–and was introduced to the Financial Health Network and the concept of financial health. I realized this is precisely what SpringFour is doing and has always been about— helping people get back on track and live a financially healthy life.

Everything that we do and have done since 2005 is about financial health. I was excited to realize that there was a concept that encompassed what SpringFour does. I left feeling energized. That summer, we applied for an award from the Promontory Financial Group, and we learned that fall that we had won the 2015 Empowerment Award. This was a defining moment for SpringFour, and coincided with our rebranding as SpringFour from Mortgage Keeper. We knew what we had built went beyond mortgages and foreclosure assistance and our brand needed to encompass that.

Being at the EMERGE Forum, I was able to meet with so many different people from banks, fintechs, and other organizations that were new to me, and several partnerships spurred from that. The event really is a who’s who of those you want to talk to in this field. After attending the conference for several years, SpringFour became a member of the Financial Health Network in 2019 because we understood that these were our people. Never have I attended a conference where everyone seemed to be on the same page, where everyone was truly focused on the same mission.

What made SpringFour decide to pursue being a Financial Health Network Leader?

SpringFour has been a leader in financial health for 15 years, as have our leadership team prior to working for SpringFour. When we started SpringFour, no one was talking about financial health. This was a natural fit for us. Several of our clients are in the program, and we saw an opportunity to further our work and strategic partnerships that have financial health at their core.

“SpringFour was selected as a 2020 Financial Health Leader as they will be using financial health measurement and transactional data such as bill payment rates and credit scores to evaluate customer’s financial health. This will help them adjust products and offerings to be more responsive to the financial health needs of their customers.” -Rob Levy, VP of Research and Measurement for Financial Health Network

Now that SpringFour is a part of the Leaders program, what do you see as the primary benefit to SpringFour?

The camaraderie! Being a part of this group of esteemed leaders dedicated to financial health is very validating. We get different exposure to some Financial Health Network members that we work with more closely through this group, and we are looking forward to sharing best practices and collaborating on research.

What are the unique things that SpringFour brings to the table within the group?

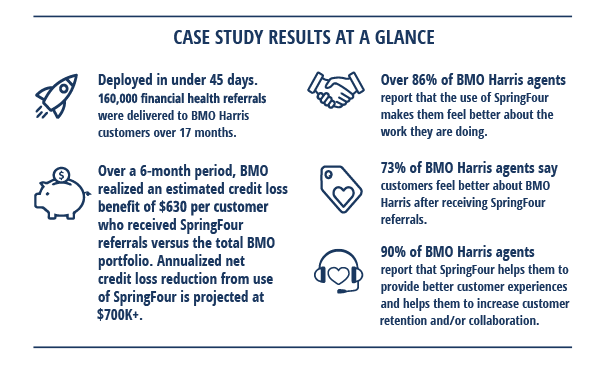

Our track record, long history, scalability, and ability to work with multiple sectors that are focused on financial health. When we bring on a new client, we have the opportunity to quickly impact their customer base. All of a sudden, their portfolio has the opportunity to access financial health resources that can make a real difference. We are unique because we are not focused on providing products direct to the consumer. Our focus is on bringing value to those financial health leaders who work with consumers, from banks to fintechs to nonprofits and employers. We are a neutral third party that has the mutual benefit of the end consumer and the company in mind. We want people to be able to save and get out of debt at the same time that we want companies to get repaid and maintain positive relationships with their customers.

What is SpringFour’s goal as a Financial Health Network Leader?

We are a mission-based, woman-run fintech company that has managed to grow over the years without raising outside funds, and we are able to work with any company that wants to help its constituents manage their financial health. We know that when you can get to the root cause of financial issues, you can help people get back on track. We want this vision to become an integral part of what companies do, and in doing so we all win–the customer, the company, and the field as a whole. We have a unique opportunity to play a major role in that by interfacing with other companies that have the same overall vision of financial health. Though we are small, through this work, we see large scale impact on millions of people. Through the Leaders program, we can share impact with others who are doing this type of work.

SpringFour partners with several of the Leaders in the Financial Health Network’s program. Could you tell me a little bit about how SpringFour works with other Leaders?

We are proud that we were already in partnership with the following Financial Health Network Leaders: Balance; Elevate; GreenPath; MMI; OppLoans; and SalaryFinance. Some are new and others have been working with us for years. That says a lot. Again, it is unique how we are able to work with nonprofits as well as fintech, employer-based and financial institutions. All of these organizations trust and rely on SpringFour to add value to their offerings and impact their bottom line. By providing access to vetted, curated fin health resources, SpringFour is helping these organizations further assist their customers. We enable them to provide tangible assistance that elevates a difficult conversation, by delivering actionable next steps and ensuring that the consumer at the end of the line sees their bank or lender as their partner.

The Financial Health Network helps amplify our voice and mission as a company. We are proud to be in the Leaders Program.

Katy Jacob

VP of Research & Impact, SpringFour

Awards and Recognition

Recent Comments