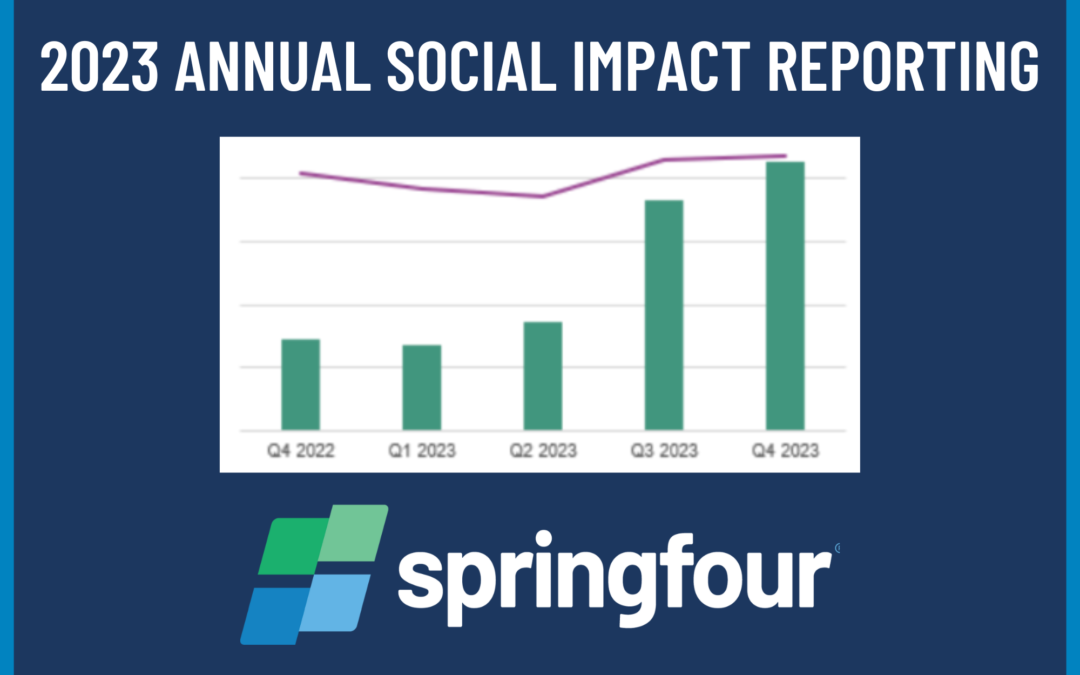

Helping Clients Showcase Their Impact with Annual Social Impact Reporting

Helping Clients Showcase Their Impact with Annual Social Impact Reporting

As social impact becomes a core measurement of success to more companies at SpringFour, we’ve seen an increasing need for social impact reporting from our clients. For many of our clients, Q1 is a time to look back at all the work done in the previous year to prepare ESG (Environmental, Social, Governance), CRA (Community Reinvestment Act), CSR (Corporate Social Responsibility), and other reports that show how their companies are making a difference for their customers, employees, and beyond.

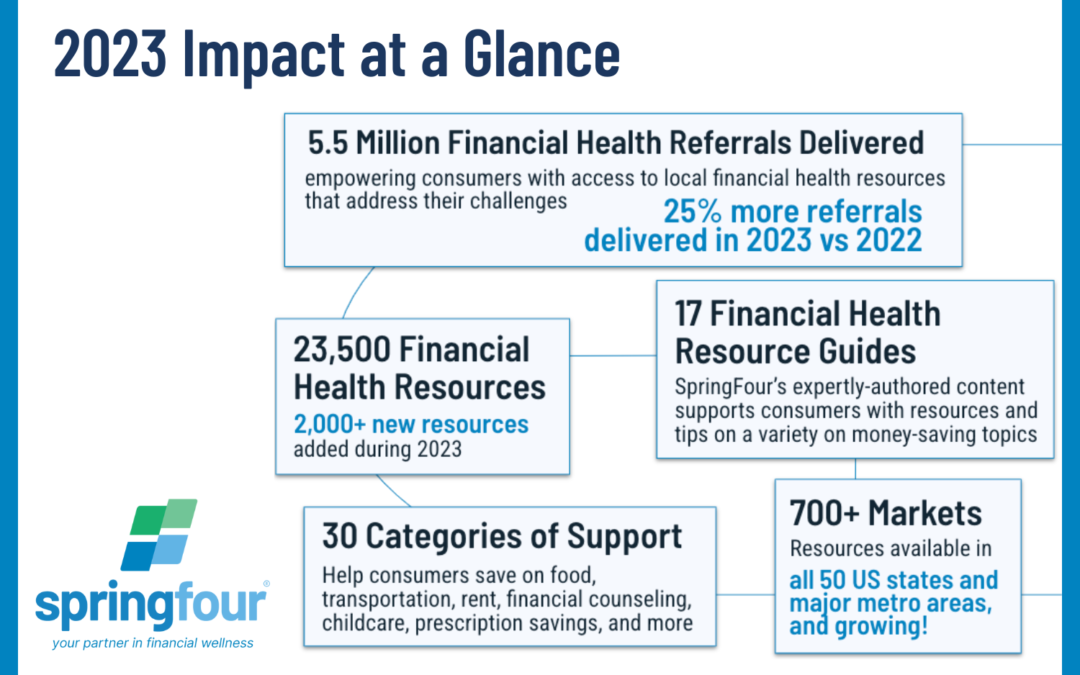

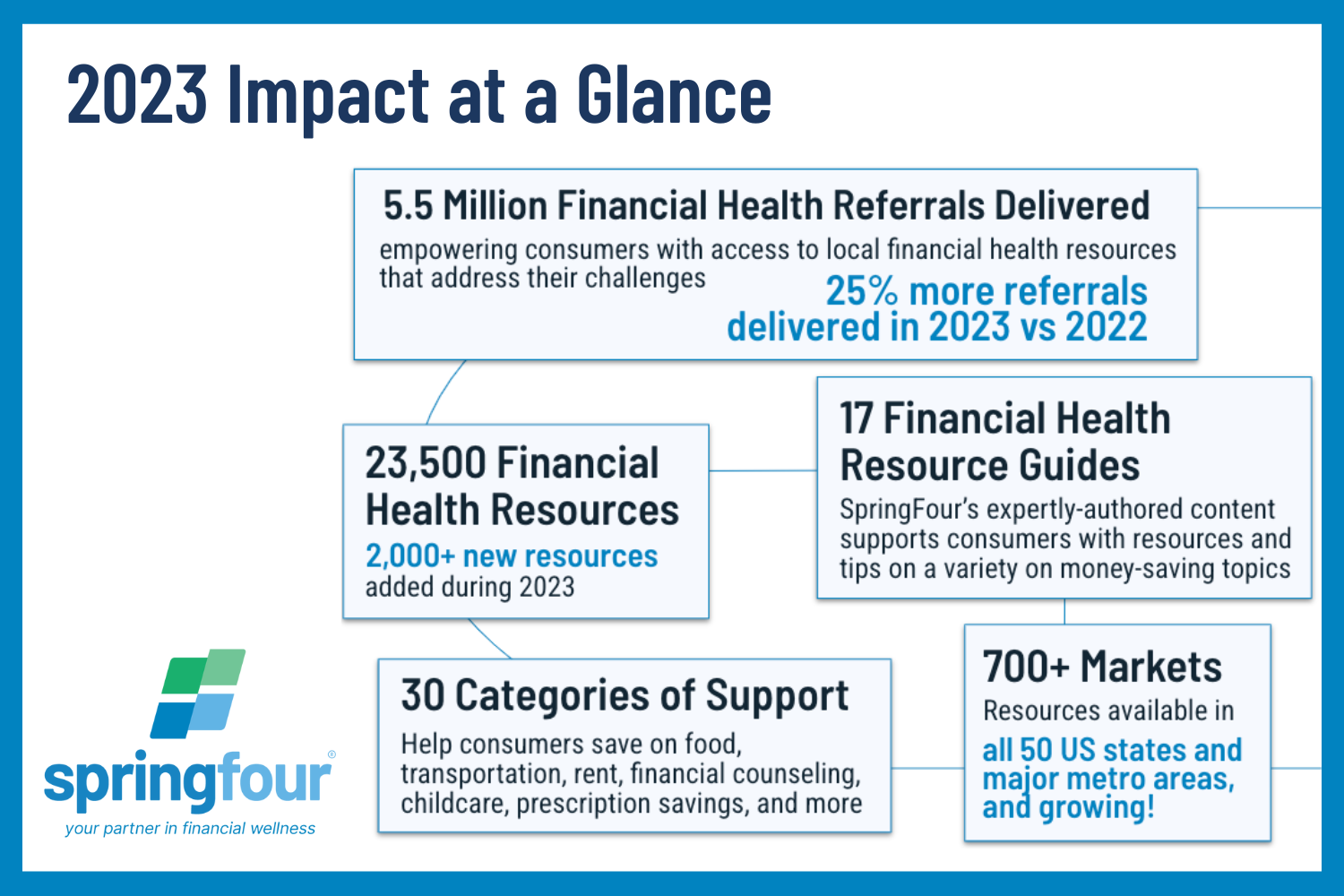

With social impact at the center of our business, we’ve spent the last few weeks preparing customized, annual Social Impact Reports. These reports showcase the impact we made with each client to support their customers in 2023 through the use of SpringFour financial health referrals.

We know that behind every SpringFour referral is a real person accessing financial assistance resources that can make a tangible difference in their lives. In fact, 91% of S4pro users agree that providing access to these resources helps people reduce their monthly expenses. And it’s not just our clients’ customers who benefit from these referrals, but also their employees and their bottom line.

Because of the impact these referrals have, our clients often use these reports to:

- Highlight the important work they’re doing to help their customers improve their financial health

- Bolster annual ESG, CRA, CSR, or social impact reporting

- Share with stakeholders and regulators how they’re helping to strengthen the communities they serve

- Better understand the ever-changing needs of their consumers

We’re incredibly proud to work in partnership with our clients to make financial health possible for more of their customers than ever before. As these reports make their way to our clients’ inboxes, we’re excited for them to see the impact they had in 2023 so that, together, we can create strategies to reach even more people in 2024.

For more information about our annual Social Impact Reports, please reach out to impact@springfour.com.

Phylicia Clifton

Senior Client Success and Impact Manager, SpringFour

Awards and Recognition

Rochelle Nawrocki-Gorey

Rochelle Nawrocki-Gorey

Recent Comments