Challenges consumers will face in 2025: What our data predicts

Challenges consumers will face in 2025: What our data predicts

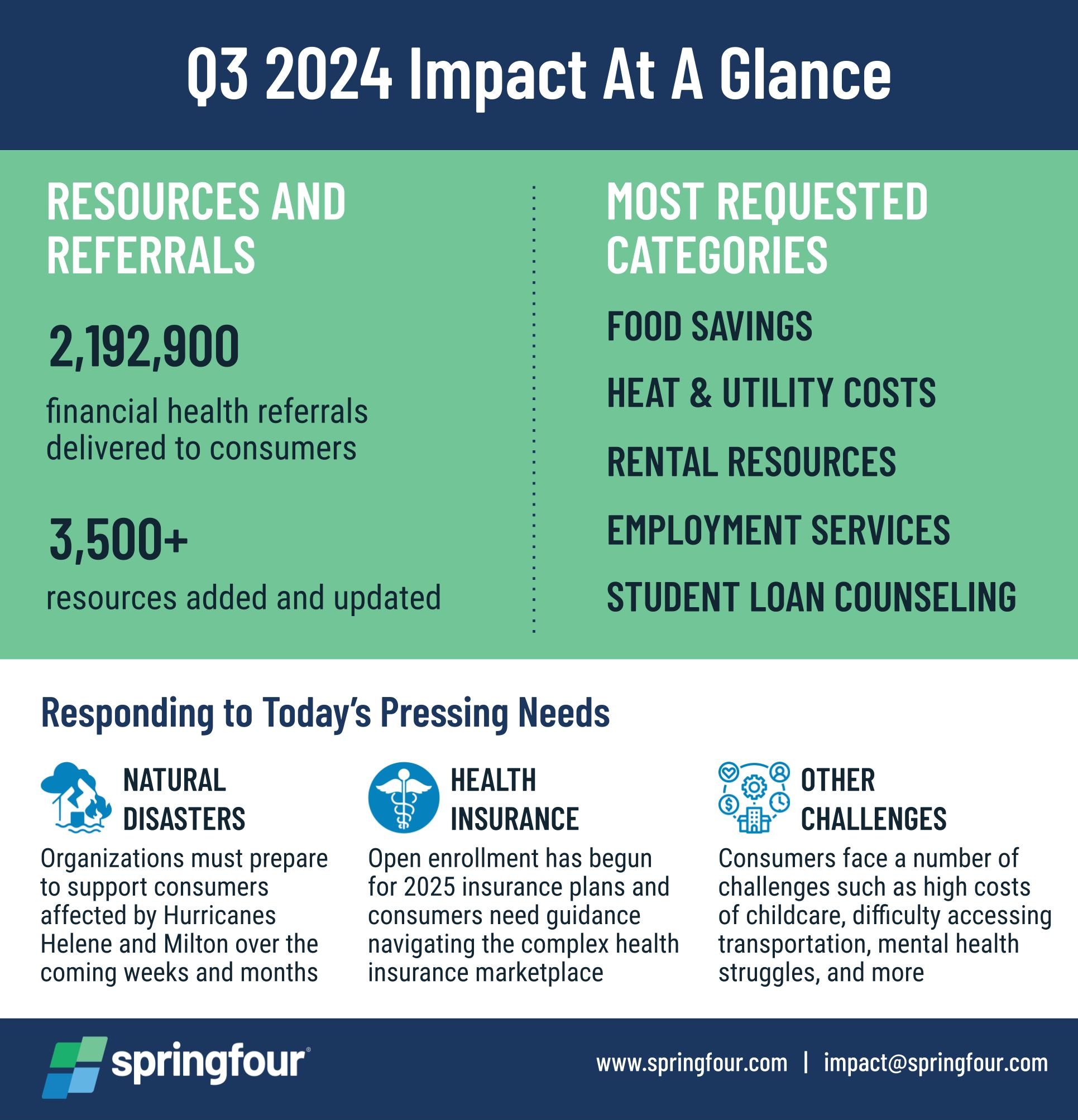

For many consumers, 2024 was filled with financial challenges, and according to our predictions, 2025 will present much of the same: prices will be high and many people will struggle to make ends meet. As consumer data and stories show, there are some financial areas where people will feel more stretched in 2025 and ways that financial health resources can help meet those needs.

Transportation costs will put employment, education, and financial health at risk

Having a way to get to work and school — whether with a car or public transportation — is essential to financial health.

Rochelle Gorey, CEO & Founder of SpringFour (which added a Transportation Savings category in Q3 2023) explains why:

“Transportation is essential to helping people keep jobs, continue their education, support the economy, and stay connected to their family and community. Everyone deserves access to transportation and resources that empower their financial health journey.”

With the cost of transportation, including car expenses, transit tickets, and ridesharing services, on the rise in 2025, following a demand for transportation financial health resources up 24% from Q2 2024 to Q3 2024, transportation health resources will be key next year.

Banks and financial institutions will be on point for disaster relief support

Daily expenses such as transportation may be where much of people’s expenses will go in 2025, but unexpected bills can hamstring consumers’ financial health for months or years. Hurricanes, tornadoes, and wildfires leave waves of destruction, upturned lives, and companies scrambling to support their customers and employees with financial relief.

As natural disasters become more frequent and more severe in 2025 and beyond, companies can no longer wait for disasters to destroy their communities to organize resources; they must proactively plan for how to support consumers through difficult times.

As Gorey recently shared in American Banker, “Banks have an obligation to plan ahead for natural disaster relief.” Supporting customers means creating a centralized space for disaster relief resources, which SpringFour partners saw value in as they have been working diligently with consumers after Hurricanes Helene and Milton. SpringFour saw demand for resources rise by nearly 38% in Q3 2024 over Q2 2024, and a 144% increase year-over-year in Q3 2024 over Q3 2023.

Financial health and mental health will remain intertwined

Financial health challenges not only hit bank accounts, they can also take a toll on physical and mental health. A survey by MarketWatch found that 41% of respondents agreed that finances were destroying their mental health.

As a Financial Health Network study, “Firsthand Perspectives Exploring the Mental-Financial Health Connection,” reported, financial shocks trigger stress and poor mental well-being while poor mental well-being is associated with negative financial impacts — creating a vicious cycle.

As mental health challenges grow across the country in 2025, mental health services, and resources to help pay for them, will be in greater demand. Moreover, giving people access to mental health resources while protecting their privacy will be crucial to helping them overcome the stigma they may feel about seeking help. Eliminating barriers to access will be part of the solution in 2025.

Student loan payments will continue to challenge consumers, second only to mortgage debt

Student loan debt is one bill that consumers may dread opening, and is now the second-largest consumer debt balance in the country second only to home mortgages, with nearly 42.8 million borrowers strapped with federal student loan debt.

While periods of forbearance put federal student loan payments on hold, payments will resume in February 2025 and organizations will need to prepare to support borrowers to avoid default.

Income-driven repayment plans, such as the SAVE plan, and other support for student loan borrowers will be crucial to helping them maintain their financial health in 2025, as loan forgiveness changes loom.

Financial coaches, agents, and counselors will be central to the solution

Accessing financial resources digitally truly helps consumers improve their financial health, but there’s no denying the need for human support in hand with digital tools. While data points are crucial to understanding where consumers will need the most support in 2025, stories from financial coaches, collection agents, and counselors, add to the picture to see how resources are part of the winning solution.

Learn more about how partnering with SpringFour can help your organization support consumers as they face financial challenges in 2025 by emailing us at impact@springfour.com.

Morgan Pierce

Impact and Communications Manager, SpringFour

Awards and Recognition

Recent Comments