Rochelle Gorey is the founder of the women-led social impact fintech company, SpringFour. SpringFour is based out of Chicago and provides financial health referrals to consumers by partnering with banks, credit unions, employers, mortgage servicers, and nonprofits. I chose to speak with Rochelle, a family friend from my hometown of Downers Grove, Illinois, because I have always been curious about how SpringFour works, and I wanted to learn more about Rochelle’s entrepreneurship journey. Following Rochelle on Instagram, I knew she was extremely accomplished in the business world, being named one of the most influential women in fintech in 2024 and as a 2024 Inc. Magazine Female Founders 250 honoree. Especially as a young woman with a passion for social justice, I have always been inspired by Rochelle’s ability to marry social impact with fintech. I hoped speaking with her would help me find guidance as a woman who aims to use my business skills to make a difference in a male-dominated field. After speaking with her, I am even more inspired by Rochelle’s passion to make a difference. SpringFour continues to grow in its impact, delivering 5.5 million financial health referrals to customers in 2023 and more than 8 million in 2024. There is a need for Rochelle’s business, and I was thrilled to learn more about how she generates this increasing value for her customers.

Rochelle grew up with parents who were both social workers. Recalling her childhood, Rochelle looks back on her parents as “amazing human beings with careers helping people, but they were not being paid much to do that.” She remembers living paycheck to paycheck, having food stamps at certain points, and receiving free hot lunches. “I felt ashamed,” she admits, in reference to living in a low-income household. “I wish I had not felt that way, but that is the nature of having financial challenges.”

Rochelle went to college with the help of financial aid, where she studied pre-law and public policy, always holding a deep interest in housing issues. When she graduated in 1987, there was a huge increase in homelessness, and Rochelle was further intrigued by how she could solve the housing crisis and create affordability. After 20 years working on social justice issues like affordable housing, she better understood low-income neighborhoods and what they needed, along with policies and programs that could bring resources to those communities.

Rochelle credits all these experiences as setting her up perfectly to create SpringFour. In the 2000s, there was an increase in predatory lending, subprime lending, and mortgage delinquencies. People were losing homes to foreclosure to no fault of their own, so Rochelle began working as a consultant. She connected people in the Chicago community with nonprofits and resources. While these nonprofits and government programs were created with the goal of helping people in mind, Rochelle noticed that, often, people did not know about these services. Therefore, Rochelle set out to solve the problem of people needing financial health solutions but not knowing where to find them. “It was the right time to do it,” she recalls.

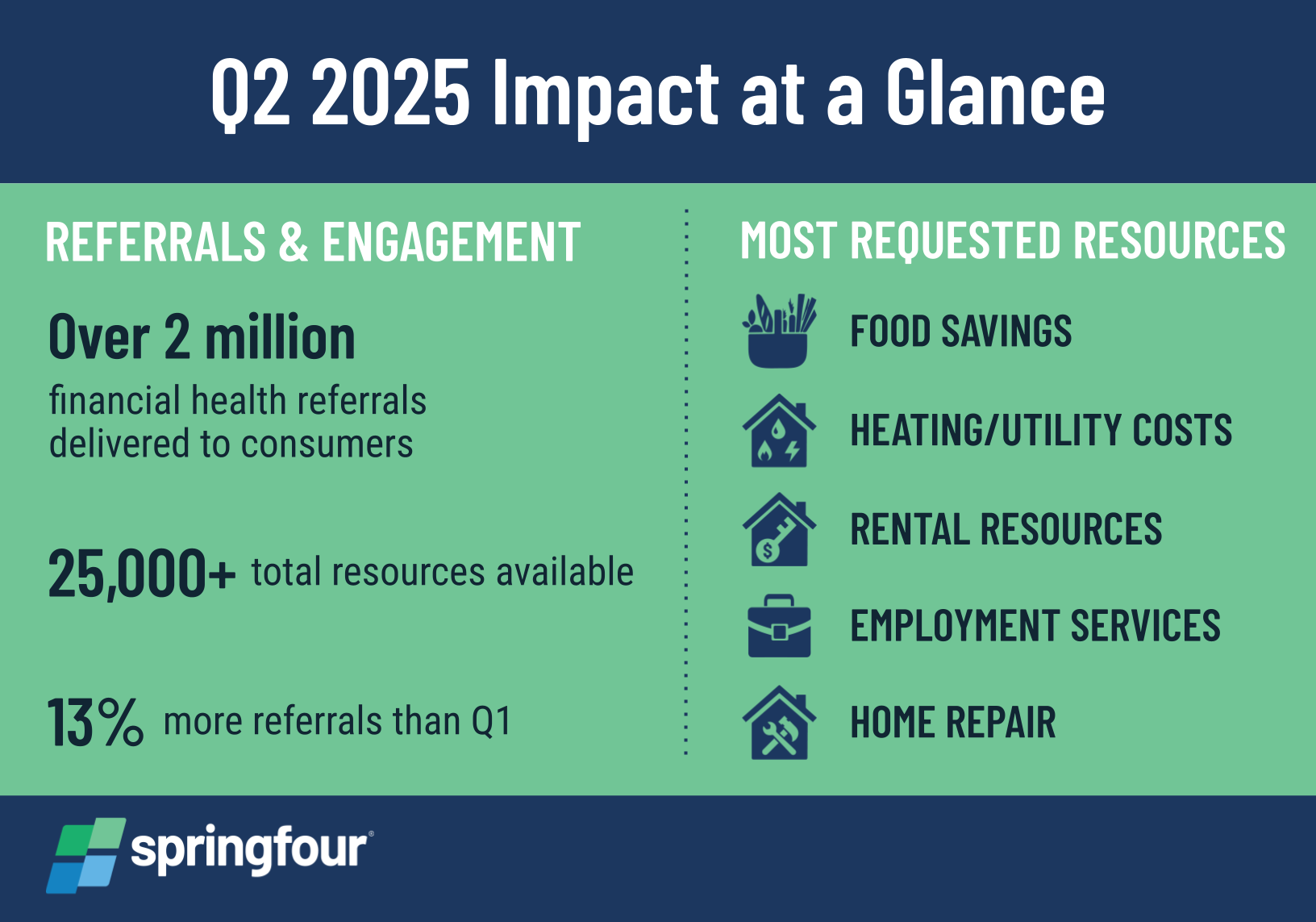

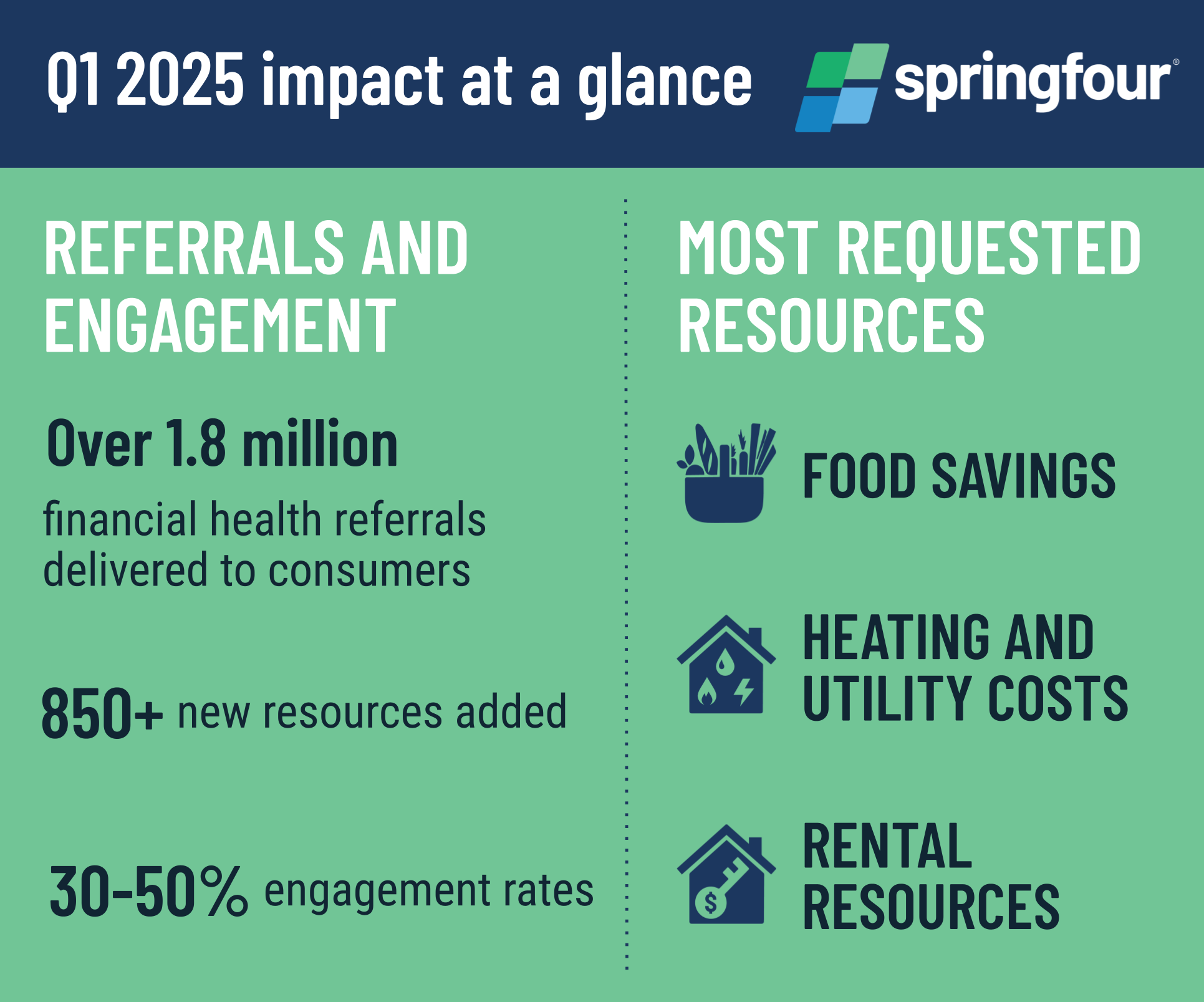

In 2005, Rochelle created SpringFour: a tech company with a contact center tool that connects individuals with financial assistance programs. SpringFour is a B2B2C (business-to business-to-consumer). Their clients are financial institutions that buy SpringFour’s products to deliver financial health referrals to customers and employees. Clients such as BMO, Fifth Third, and Capital One can do a ZIP Code search and help their customers make connections to over 25 distinct categories of need in their area, including food savings, heating and utility services, legal, employment, and disaster recovery. Rochelle’s goal with SpringFour was to change the culture around financial assistance. Instead of being unaccommodating, Rochelle encouraged bank agents to approach financial health issues in an empathetic manner. She urged banks to tell consumers: “I understand you have a problem with your payment. What is getting in the way of it?” Then, this customer could be connected to SpringFour’s resources. Rochelle also noted that the connections listed in SpringFour are vetted to assure they meet the company’s standards and guidelines. SpringFour only includes nonprofits and government resources, connecting people to the real “helpers.”

SpringFour differentiates itself from other fintech companies because it is “not in the business of making money off of people.” The consumer’s best interest is always at the forefront, and the social impact has been an important part of the organization since day one. It is never a cost to the customer to use SpringFour. The company’s curation of resources assures that customers are never presented with a dead end. As SpringFour’s website states, “SpringFour’s solutions have fed families, kept people in their homes, reduced prescription costs, found people jobs, secured childcare, & so much more” (SpringFour).

In creating her business, the biggest challenge that Rochelle faced was breaking through the market. When she first started her company, “No one knew what we were talking about.” The hardest part of Rochelle’s startup process was getting that first big client to trust her and take that leap of faith, embracing modern technology and innovation in financial services. When pitching SpringFour, Rochelle said it was important to help clients understand that the company was not selling a product that was going to make more money for banks, but rather, would help them retain their current business: an equally valuable goal that can be more difficult to accomplish. SpringFour’s website contains a variety of statistics that support the company’s success in creating trust between financial institutions and consumers, with consumers using SpringFour’s referrals being 2-10x more likely to increase repayment rates (SpringFour).

Rochelle also mentioned the struggles that come with being a woman in business. “You do not get as much attention or funding. Men can present an idea that has no traction and get a million dollars, but women get questioned. There is a vastly different standard.” Women only receive 2% of the venture capital out there, yet women-founded businesses are more successful and more profitable. Women-led companies also have a higher social impact. “I’m not going to stop talking about this,” Rochelle states. I told her how the entrepreneurs who visited my class, most of them male, shared that, from their perspective, being a woman in business is difficult. Rochelle’s response: “To that, I would ask, how are you helping women in your field? What are you doing to change that reality?” She raises a question that I think we need to continue asking.

Rochelle cites her biggest success as helping people. She is proud of her ability to grow fast and scale quickly with an all-women team who is intrinsically motivated and passionate about getting SpringFour out there. She also cites the awards I previously mentioned as validating that SpringFour is doing what it set out to do: to change the banking industry and how it handles financial health.

The key lesson I learned from Rochelle is the importance of being connected to your mission. Rochelle acknowledges that many young people want to have a startup or start a business, but she suggests creating something that you are deeply connected to. Her team is extremely tied to SpringFour’s purpose with a clear set of guiding principles.

Speaking with Rochelle, I learned that you must keep going; it is a no until it is a yes. A phrase she often uses with her team is that “We are not selling refrigerators,” meaning, not everyone believes they will need her business, but she set out to show financial institutions that SpringFour is a must-have, especially when 60% of Americans live paycheck to paycheck. Therefore, I will take away the lesson that entrepreneurs have the power to change the dialogue around an industry and help customers in new, innovative ways if they challenge the norm.

I learned that the most important part of leadership is empowering your team and allowing them to control their work. SpringFour is a very high-performance team and that is because of the empowerment Rochelle grants to her employees to be in control of their own work. This company is a prime example of why it is important to hire a team that you trust and value.

Lastly, Rochelle taught me that it is important to reflect on your work journey to discover, not only what you like in a workplace, but also what you do not like in a workplace. You can learn from unpleasant work experiences and decide how to be better when you eventually take on a leadership position.

Learning about SpringFour changed the way that I view social entrepreneurship. Rochelle set out asking “How do we help people have better financial health?” and her answer was SpringFour; her motivation and ability to realize an entrepreneurial dream has showed me how a passion to help others can create a thriving business. Rochelle encouraged aspiring entrepreneurs like me to “Think of your customer and how you can be a service to them. At the end of the day, we are selling something, but why are we doing that? How are we helping them be the hero of this story?” SpringFour’s mission to empower consumers to take control of their financial health is a message I will carry with me, as I strive to create solutions that not only address social issues but also empower others to thrive.

Recent Comments