SpringFour Partner of the Month: Golden 1 Credit Union

SpringFour Partner of the Month: Golden 1 Credit Union

Driving Member Engagement Through Timely Financial Health Support

We’re excited to kick off our new Partner of the Month series by highlighting a standout organization delivering meaningful financial health support and driving real business impact: Golden 1 Credit Union.

Through its partnership with SpringFour, Golden 1 demonstrates how prioritizing member wellbeing deepens trust and engagement and reinforces long-term loyalty.

A National Leader with a Community-First Mission

With more than 1.1 million members and over 2,000 employees, Golden 1 is one of the largest credit unions in the United States. In 2025, it was recognized with national distinctions both for excellence in business service and outstanding company culture.

As a member-owned, not-for-profit institution, Golden 1 goes beyond quick fixes and invests in the communities it serves, offering financial education workshops that help members build healthy financial habits, and supporting neighborhood-based organizations that strengthen the communities they serve.

A Partnership Built on The Business Impact of Putting Members First

Golden 1’s partnership with SpringFour is rooted in a shared belief that financial services should deliver both measurable results and meaningful impact.

That alignment existed even before our formal partnership. Both SpringFour and Golden 1 were named two of the three Fast Company 2023 Brands That Matter in the financial services category — a reflection of a shared commitment to improving financial wellbeing through purpose-driven innovation.

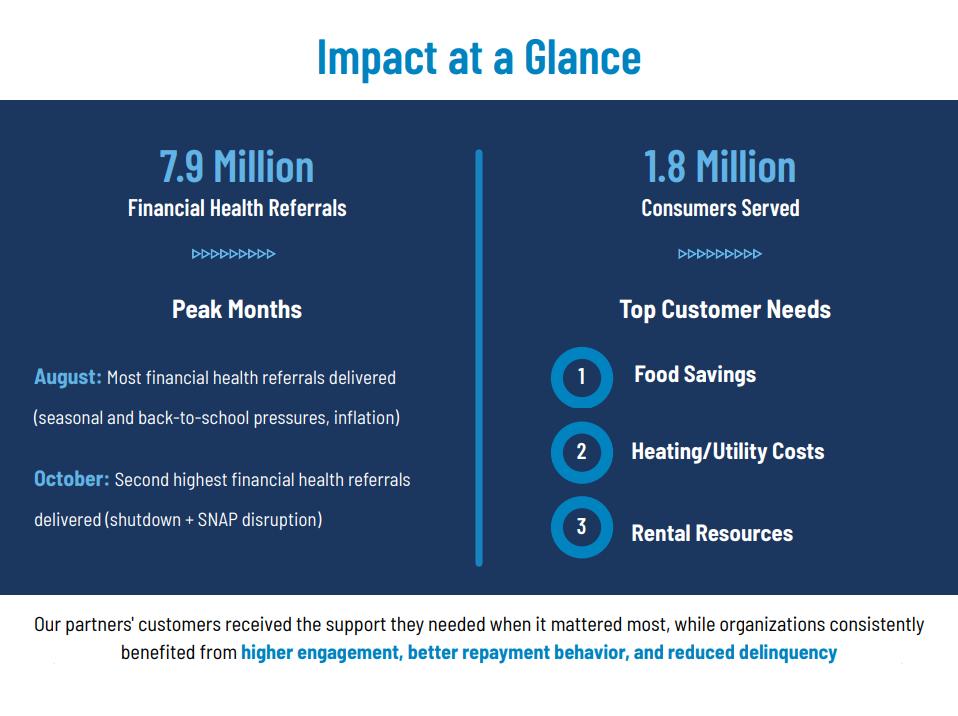

When financial institutions proactively connect members with timely, relevant financial support, the results extend far beyond the moment of need. This approach reinforces confidence in the institution and creates a more engaged member base.

Golden 1 Credit Union’s commitment to financial wellbeing shows how delivering the right support at the right time is both mission-driven and business-smart.

Expanding Access to Support When It Matters

In 2025, Golden 1 expanded access to SpringFour resources during key moments in members’ lives:

- During tax season, Golden 1 proactively made SpringFour resources available to help members find rent relief, food assistance, and other essential savings programs when seasonal expenses were high.

- During the government shutdown, Golden 1 launched a Payroll Assistance Loan program for members experiencing disrupted pay, waived early withdrawal penalties, and offered loan payment assistance options – a coordinated response designed to stabilize members financially during prolonged uncertainty.

As part of these efforts, Golden 1 directed members to SpringFour for personalized financial health resources, making it possible for members to access trusted, local resources that reduce household expenses.

Strengthening Engagement Through Comprehensive Support

By pairing financial products with actionable, local resources, Golden 1 helps members reduce expenses, stabilize their finances, and stay on track — helping drive stronger member engagement, deeper trust, and more resilient financial relationships.

This integrated approach reflects a company culture deeply rooted in member wellbeing and delivers clear value for both members and the institution.

A Win-Win Approach to Financial Health

We see it every day: organizations that choose to deliver financial health resources are making the smartest business move available. Golden 1’s approach shows how supporting members’ financial wellbeing is not only the right thing to do — it’s a powerful driver of sustainable impact. When members can reduce expenses and stabilize financially, they stay loyal and better positioned to meet their financial obligations.

Congratulations to the Golden 1 Credit Union team for setting the standard and kicking off our Partner of the Month series with a powerful example of what’s possible when organizations lead with a commitment to their customers’ financial health.

Awards and Recognition

Recent Comments