Financial Health Survey of LMI Families

Financial Health Survey of LMI Families

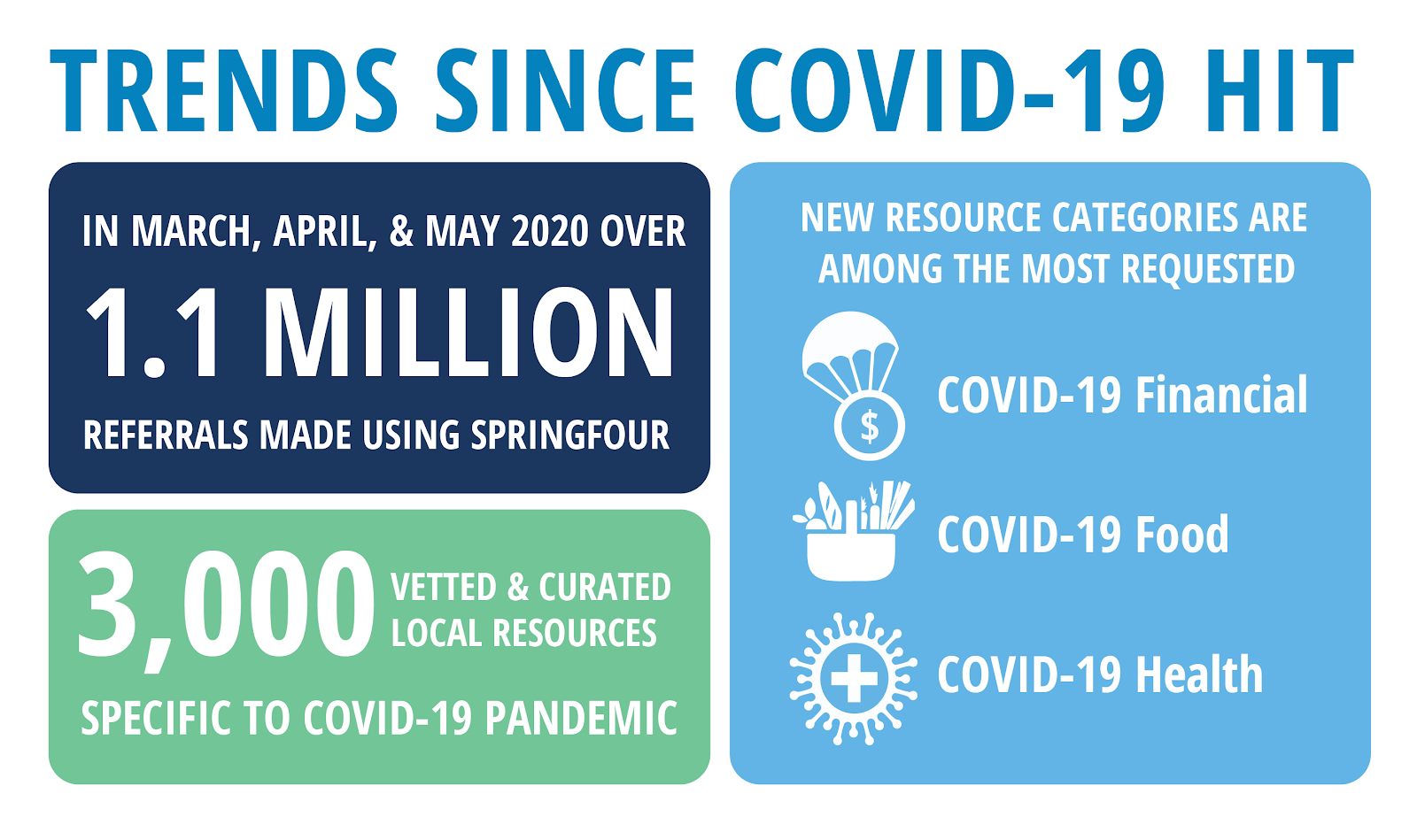

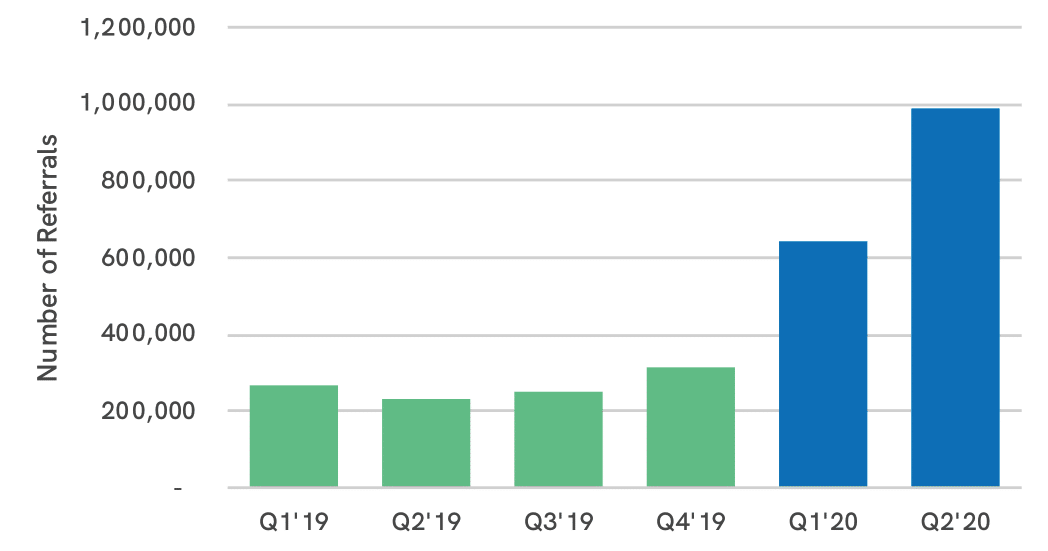

SpringFour, the only social impact fintech that helps financial institutions give customers the support they need to regain financial control, today published the results of its COVID-19 financial health survey, which shares how the pandemic has impacted low- and moderate-income households.

The insights reveal that the pandemic has impacted families’ ability to cover their monthly expenses and pay for basic resources, including food, prescriptions, and utilities. Households state that they need $4,000 in an emergency fund. Many families are unaware of financial resources that exist to help, but trust their banks to provide financial guidance and support. SpringFour commissioned Competiscan for this survey, which included a nationally representative sample of 105 individuals with household incomes of under $50,000 per year.

A complimentary copy of the report can be accessed here.

“The pandemic has made financial challenges even more acute for low- and moderate-income families. The government’s stimulus payments have not alleviated their financial pressures and many are unaware that local resources exist to help them cover basic needs,” said Rochelle Gorey, SpringFour Co-Founder and CEO. “The good news is that families feel confident in their banks’ ability to help, giving banks the opportunity to step up and meet their clientele’s challenges.”

Key takeaways include:

Unemployment has greatly impacted low- and moderate-income families: 26% have been furloughed, let go, or had their work hours reduced.

Households are facing challenges in making regular payments: 30% of families are unable to cover their monthly expenses completely and on time.

Families expressed concern about covering the following expenses:

70% are not confident that they can set aside money for emergencies.

55% are concerned about paying for basic necessities, like food, utilities, and health care.

40% are concerned about paying their credit card bills on time.

Households expressed a need for financial assistance to cover basic resources, including food (47%), heating/utility costs (47%), prescription savings (40%), health care savings (40%), and home repair (39%).

Families do not know where to turn for financial assistance. 40% are unaware of local resources to reduce household expenses.

Households want to receive financial guidance and support from their financial institutions: 83% expressed interest in receiving support from their banks.

Families lack the necessary emergency funds. 47.6% stated that they need more than $4,000 in an emergency fund.

Families expect the pandemic to have long-term implications. 41% stated that once the country opens up, their financial situation will not change.

“Research in the financial health field has long shown that families are one step away from a financial emergency and that they do not have sufficient funds to cover an unexpected expense. The survey results show that a crisis like COVID-19 uncovers the need for long-term, ongoing solutions,” said Katy Jacob, SpringFour Vice President of Research & Impact. “Families know they don’t have enough money saved and they need financial support and specific, targeted resources that help reduce household expenses and create opportunities to save for emergencies.”

Learn More

For more information, download a copy of the report here.

Katy Jacob

VP of Research & Impact, SpringFour

Awards and Recognition

Recent Comments