Research and Insights

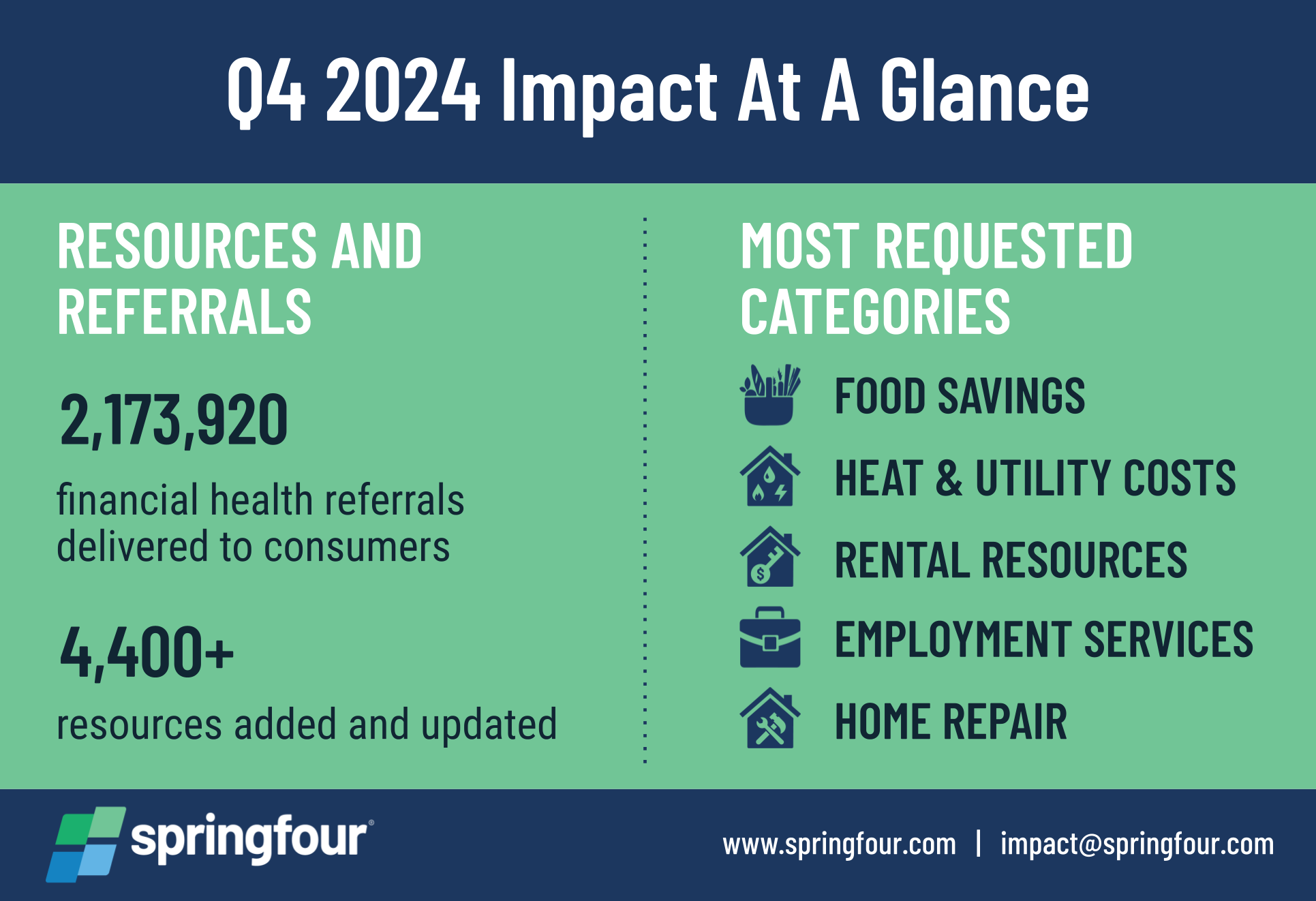

Just Released: SpringFour’s Q3 2024 Impact Report

We are proud to announce the release of SpringFour’s Q3 2024 Impact Report!The third quarter was like no other because SpringFour was acquired by C&R Software, a CORA Group company and subsidiary of Constellation Software, Inc., the 23rd largest software company in the world with an $80B market cap! Read more about our Q3 impact and how SpringFour is delivering much-needed support — when and where it’s needed.

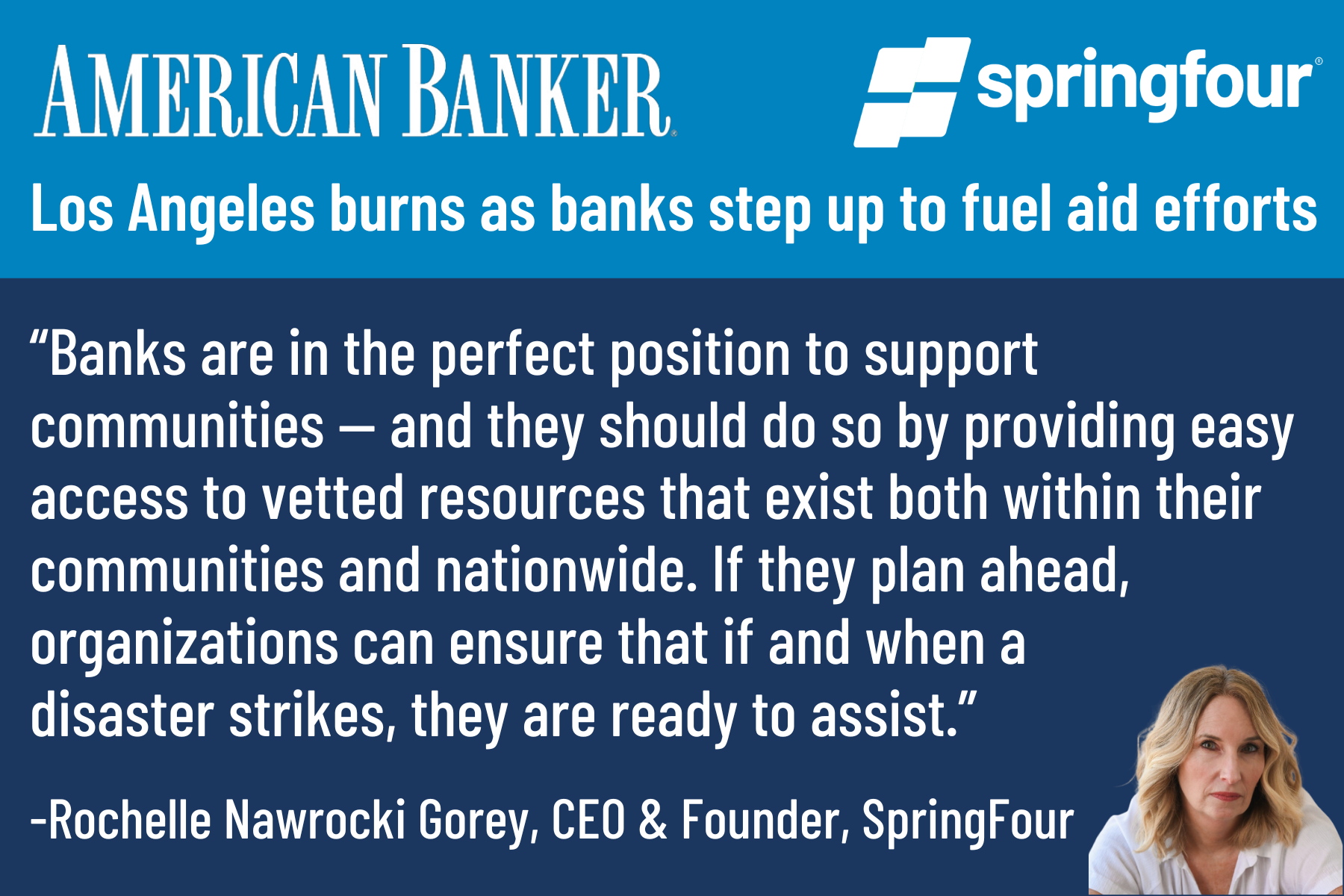

How we support people through natural disasters, healthcare access, home purchases, and more

SpringFour empowers organizations to support consumers facing challenges with natural disaster recovery, health insurance and healthcare, home purchases, paying a mortgage, and more. Whatever your organization’s needs are to support consumers, now is the time to leverage a partnership with SpringFour to drive financial health and business impact!

SpringFour’s Added Health Insurance Resources Ease Open Enrollment Puzzle

SpringFour today announced the expansion of its health insurance resources, at a pivotal time when many Americans are weighing their insurance options. By expanding its solutions to include nonprofit local Health Insurance Navigators, SpringFour offers a lifeline to the uninsured during the crucial open enrollment period starting November 1.

Fay Servicing Empowers Homeowners with Financial Assistance Through SpringFour Partnership

Fay Servicing and SpringFour’s innovative partnership provides over 96,000 essential resource referrals, strengthening financial stability for homeowners nationwide. Through its longstanding partnership with SpringFour, the leading social impact fintech, Fay Servicing has facilitated over 6,000 referrals in the past year alone, helping homeowners navigate financial difficulties and maintain homeownership.

Showcase Your Annual Social Impact: How SpringFour ESG Reporting Drives Your Goals

Each year, SpringFour delivers Client ESG Reports that help organizations measure and showcase the impact they’ve achieved with SpringFour. These reports provide metrics that integrate seamlessly into the social (S) and governance (G) sections of organizations’ annual ESG and impact reports, empowering organizations to demonstrate accountability by measuring the financial health support they provide with SpringFour. SpringFour’s Client ESG Reports provide metrics based on the use of their organization’s SpringFour product(s).

As HAF Shutters Its Doors, SpringFour Delivers Homeowners Much-Needed Assistance

SpringFour has unveiled its revamped and expanded mortgage relief resources as the American Rescue Plan’s Homeowner Assistance Fund (HAF) programs shutter their doors. In the face of high home prices and steep mortgage rates, the social impact fintech will connect struggling homeowners with financial health resources to get back on their feet.

Awards & Recognition