Research and Insights

Research and Insights

2024 Annual Impact Report: How We’ve Changed Financial Services For Good

2024 was a defining year for financial health — and for SpringFour. Our acquisition by C&R Software marked a major milestone, enabling us to scale our mission and bring financial health solutions to more organizations and the people they serve than ever before.The impact speaks for itself: 8.5 million+ referrals delivered (a 54% increase from 2023), 2,000+ new resources added, and recognition from Inc. and American Banker for our leadership, innovation, and impact in financial health.

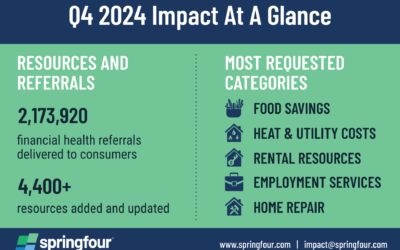

Inside Our Q4 2024 Impact Report

The need for trusted financial health resources continues to grow – and SpringFour has risen to the challenge. In 2024, we delivered over 8.5 million financial health referrals, more than ever before – connecting individuals and families with the essential support they need, through the institutions that serve them. While the world faces economic fluctuations, rising costs, and environmental crises, SpringFour continues to make a real difference. Learn how in SpringFour’s Q4 2024 Impact Report.

How we’re here for you and your customers — as always

We built SpringFour to connect people with vetted financial health resources when they need them most. Today, with rising costs, policy changes, and natural disasters, uncertainty is everywhere — and we’re here to help. From disaster relief to everyday financial challenges like food savings, rental resources, prescription savings, and more, we make it easy for the financial services industry, nonprofits, employers, and more to provide real solutions, fast.

SpringFour and MSU Federal Credit Union Announce Partnership to Improve Members’ Financial Health

SpringFour, a first-of-its-kind, leading financial health fintech, today announced a partnership with MSU Federal Credit Union (MSUFCU), a credit union with more than 80 years of history providing services to the Michigan State University community and beyond. This partnership will offer MSUFCU members—Including Michigan State University students and alumni—innovative digital tools to support their financial health.

SpringFour and Enact Partner to Provide Tools to Enable Sustainable Homeownership

The financial health fintech SpringFour and mortgage insurance provider Enact are giving financial health tools to borrowers from 1,800 lenders nationwide. The partnership supports Enact borrowers who are struggling financially by giving them no-cost access to SpringFour’s financial health resources.

10 Ways SpringFour Transformed Financial Health in 2024

For many consumers, 2024 was filled with financial challenges, and according to our predictions, 2025 will present much of the same: prices will be high, and many people will be struggling to make ends meet. Read our 2025 predictions to learn how partnering with SpringFour can help your organization support consumers as they face financial challenges in 2025.

Awards & Recognition