Leverage Our Proven Track Record to Drive Results

Leverage Our Proven Track Record to Drive Results

SpringFour Impacts

Add Brand Value

91% of users believe consumers feel more positively about their organization after receiving SpringFour referrals.

Improve Repayment Rates

Subscriber estimates a $700k reduction in annual net credit losses from the use of SpringFour.

Empower Employees

98% of agents felt SpringFour allowed them to provide better customer service.

Assist People in Need

4.4 million financial health referrals delivered in 2022.

Enable Financial Success

Consumers 2X more likely to engage in foreclosure prevention efforts after receiving SpringFour referrals.

Reduce Expenses

91% of users agree SpringFour helps consumers reduce monthly expenses.

Case Studies

Our clients are leveraging the power of SpringFour to deliver results.

SPRINGFOUR IS INTEGRAL TO ESG:

FINANCIAL HEALTH IS SOCIAL IMPACT

While the financial services industry has steeped itself in the financial health space over the last decade or so, the connection between financial health programming and ESG has yet to be fully fleshed out, representing a huge opportunity to connect the dots and demonstrate the impact of such efforts. Here at Springfour has seen how our partnerships have become an integral part of the impact story that our clients, including large banks, tell their stakeholders about the important work they do.

SPRINGFOUR IS INTEGRAL TO ESG:

FINANCIAL HEALTH IS SOCIAL IMPACT

Financial services companies play an integral role in their customers’ lives, including outside of the deposit or loan relationship. While the financial services industry has steeped itself in the financial health space over the last decade or so, the connection between financial health programming and ESG has yet to be fully fleshed out, representing a huge opportunity to connect the dots and demonstrate the impact of such efforts. Here at SpringFour, we have seen how the partnerships that we have built have become an integral part of the impact story that our clients, including large banks, tell their stakeholders about the important work they do. .

Where employers are taking financial health: A discussion with Canary and SpringFour Leaders

Recently, Katy Jacob and Rochelle Gorey of SpringFour talked with Kimberly Gartner of Canary about financial health and employer-fintech collaborations. These three leaders in the financial health industry have more than 75 years of combined experience in helping families and communities access the tools, resources, products and services they need to become and remain financially stable.

Where employers are taking financial health: A discussion with Canary and SpringFour Leaders

Recently, Katy Jacob and Rochelle Gorey of SpringFour talked with Kimberly Gartner of Canary about financial health and employer-fintech collaborations. These three leaders in the financial health industry have more than 75 years of combined experience in helping families and communities access the tools, resources, products and services they need to become and remain financially stable.

Overcoming Housing Insecurity One Family at a Time: A Case Study of SpringFour and Money Management International

Long before financial health became a hot topic, SpringFour recognized that connections to local resources could help improve financial lives and increase repayment rates. MMI has a kindred mission in seeking to help families get through a financial crisis through counseling and debt management services. Learn how the organizations have worked together to help renters maintain housing security in a time of crisis during COVID-19.

Overcoming Housing Insecurity One Family at a Time: A Case Study of SpringFour and Money Management International

Long before financial health became a hot topic, SpringFour recognized that connections to local resources could help improve financial lives and increase repayment rates. MMI has a kindred mission in seeking to help families get through a financial crisis through counseling and debt management services. Read the case study to learn how the organizations have worked together to help renters maintain housing security in a time of crisis during COVID-19.

A Chicago Fintech Financial Health Collaboration: SpringFour and Enova

Enova and SpringFour are Chicago-based fintechs working together to improve families’ financial health. The two companies began to explore a partnership in October of 2019, and by the spring of 2020, Enova had launched SpringFour resources via S4direct to its CashNetUSA and NetCredit brands. Read the case study to find out more about how this partnership helped customers through the COVID crisis and beyond.

A Chicago Fintech Financial Health Collaboration: SpringFour and Enova

Enova and SpringFour are Chicago-based fintechs working together to improve families’ financial health. The two companies began to explore a partnership in October of 2019, and by the spring of 2020, Enova had launched SpringFour resources via S4direct to its CashNetUSA and NetCredit brands. Read the case study to find out more about how this partnership helped customers through the COVID crisis and beyond.

Building Credit by Building Partnerships: A SpringFour and Self Case Study

When SpringFour and Self began working together in 2019, it was due to a mutually-held belief: Credit and savings are necessary, but not sufficient, for lower-income families to build financial health. SpringFour and Self recognize that these families also need empowerment, product choice, and assistance. To learn more about how Self and SpringFour worked together to connect financial resources to financial products, read our case study.

Building Credit by Building Partnerships: A SpringFour and Self Case Study

When SpringFour and Self began working together in 2019, it was due to a mutually-held belief: Credit and savings are necessary, but not sufficient, for lower-income families to build financial health. SpringFour and Self recognize that these families also need empowerment, product choice, and assistance. To learn more about how Self and SpringFour worked together to connect financial resources to financial products, read our case study.

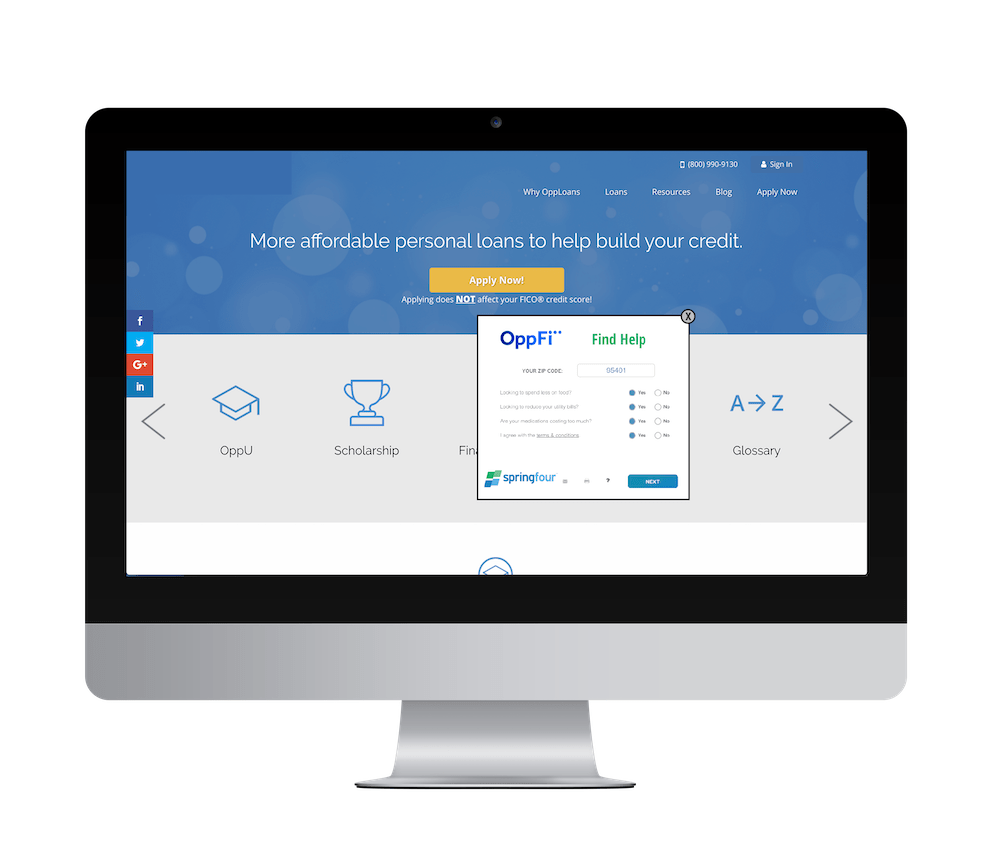

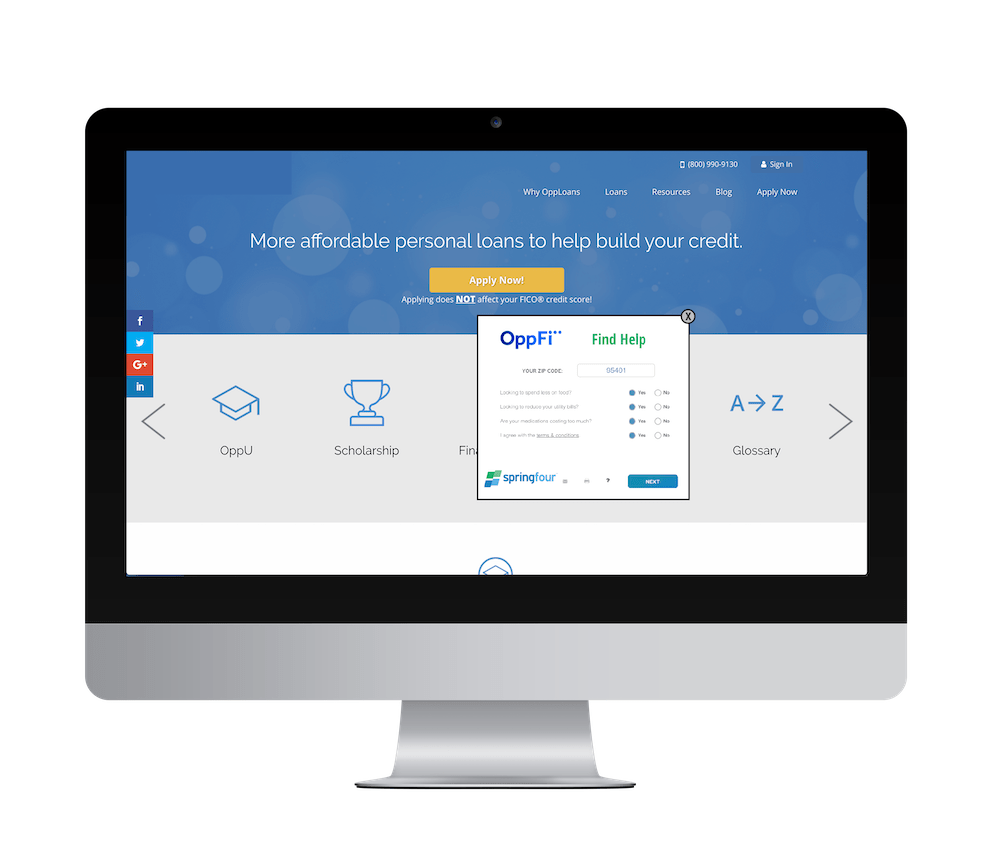

Partnering Through a Pandemic: A Case Study of OppFi and SpringFour

OppFi and SpringFour became acquainted in October of 2018 and recognized a kindred spirit in one another as mission-aligned companies focused on creating unique solutions that improve consumers’ financial lives. During the COVID-19 pandemic, the two companies quickly banded together to create a response to the pandemic to help families in critical need of resources.

Partnering Through a Pandemic: A Case Study of OppFi and SpringFour

OppFi and SpringFour became acquainted in October of 2018 and recognized a kindred spirit in one another as mission-aligned companies focused on creating unique solutions that improve consumers’ financial lives. During the COVID-19 pandemic, the two companies quickly banded together to create a response to the pandemic to help families in critical need of resources.

Helping Families Weather Financial Hardship: BMO Harris Bank Partners with SpringFour

Living up to their respective taglines, “we’re here to help,” and “your partner in financial wellness,” BMO Harris and SpringFour have forged a powerful partnership that helps individuals and families in times of financial hardship. SpringFour believes that when consumers can’t pay a bill or are living paycheck to paycheck, they need direction to local resources that can help.

Helping Families Weather Financial Hardship: BMO Harris Bank Partners with SpringFour

Living up to their respective taglines, “we’re here to help,” and “your partner in financial wellness,” BMO Harris and SpringFour have forged a powerful partnership that helps individuals and families in times of financial hardship. SpringFour believes that when consumers can’t pay a bill or are living paycheck to paycheck, they need direction to local resources that can help.

U.S. Bank Partners with SpringFour to Improve Services to Customers and Enhance Loan Performance

The U.S. Bank partnership with SpringFour is a model for how financial institutions can deliver financial health resources and benefits for their customers, employees, and the bottom line. Read the full report to find out how U.S. Bank has seen enhanced customer service, increased participation in foreclosure prevention activities, and increased repayment rates.

U.S. Bank Partners with SpringFour to Improve Services to Customers and Enhance Loan Performance

The U.S. Bank partnership with SpringFour is a model for how financial institutions can deliver financial health resources and benefits for their customers, employees, and the bottom line. Read the full report to find out how U.S. Bank has seen enhanced customer service, increased participation in foreclosure prevention activities, and increased repayment rates.

Consumer Success Stories

See how our clients have helped their customers achieve financial wellness.

Certified & Dedicated to Impact

SpringFour is proud to be a Certified B Corporation, a designation that a business is demonstrating high social & environmental performance, accountability, & transparency. Certified B Corporations are leaders in the global movement for an inclusive, equitable, & regenerative economy.

Ready to get started?

Awards & Recognition