The Looming Crisis of Healthcare Inaccessibility During the COVID-19 Pandemic

I answered: because it wasn’t available to me.

As a child and adolescent, I had epilepsy. I hadn’t taken medication nor had seizures since I graduated from high school, but for the purposes of health insurance, that didn’t matter. I, along with 130 million other Americans, had a pre-existing condition that precluded me from accessing most health insurance plans. At that time, employer-sponsored HMOs were the only non-public (not Medicaid or Medicare) healthcare options available to people like me. My peers were skeptical that I would be denied health insurance. Well, there was a mixup in my paperwork, and somehow I was put into the PPO plan. A few weeks later, I received a letter telling me that I was rejected for health insurance due to my history of epilepsy.

Until the Affordable Care Act (ACA) was passed in 2015, I was one of millions of Americans whose life chances and choices were directly impacted by the lack of affordable healthcare available for those with pre-existing (not even active or current) conditions. I could not just quit a job, move, or become a consultant or freelancer without fear of losing my healthcare and thereby facing a financial catastrophe if I experienced any major medical issue. Once married, I could not divorce if our health insurance was accessed through my spouse rather than myself. The Affordable Care Act changed all that, and enabled people like me to have personal, employment and geographic mobility for the first time without risking a health crisis that might lead to bankruptcy.

Having health care directly tied to employment has notable consequences for all Americans, regardless of whether or not they have pre-existing conditions. Since the COVID-19 pandemic began in March of 2020, more than 14 million people have lost their jobs, and 12 million have lost their health insurance along with their employment. For many, this has meant a double-whammy of sorts: the loss of income at the same time that large COBRA payments, or more expensive premiums through the Affordable Care Act exchanges, would come due. By June, more than 500,000 additional Americans had signed up for healthcare under the Affordable Care Act due to the loss of health coverage as a result of the pandemic. It is not a stretch to imagine that many of those individuals have pre-existing conditions.

Within a few weeks, this healthcare crisis might grow exceedingly worse, as the Supreme Court will take up a case in November that might overturn the Affordable Care Act, leaving 23 million people without healthcare coverage immediately, and putting at risk the third of Americans with pre-existing conditions who rely on the prohibition of exclusion from care that the Act provides.

What does this looming crisis mean for the financial health and stability of American families? The loss of healthcare through employment has led to immediate and acute need for families that can no longer afford reasonable coverage. At the same time, people are waiting to learn what will happen to their healthcare if they lose a job and/or the ACA is repealed. Further, the impact of healthcare costs is already a crisis for millions of Americans, even before any imminent policy changes.

Indeed, a majority of US adults have to delay getting medical care or put it off completely because they can’t afford it. This is not just an issue for the uninsured. Recent studies show that most people who experience difficulty paying medical bills have health insurance. The unaffordability of medical care is also impacting families’ ability to pay off their non-medical debts and take advantage of new financial products. Recent numbers show that the 137 million Americans struggling with medical debt are dipping into their retirement and savings accounts and defaulting on other loans. Another 2019 study found that one-third of credit card holders are in debt because of medical bills. Healthcare costs and access impact every aspect of Americans’ financial health.

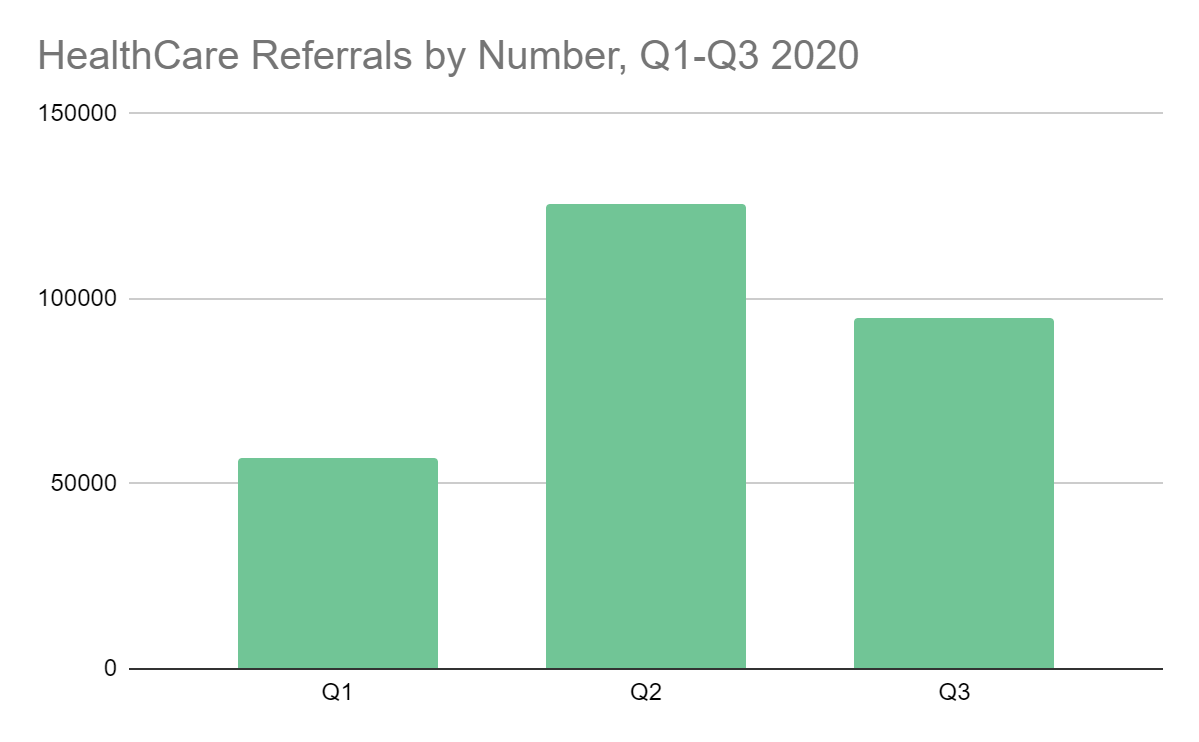

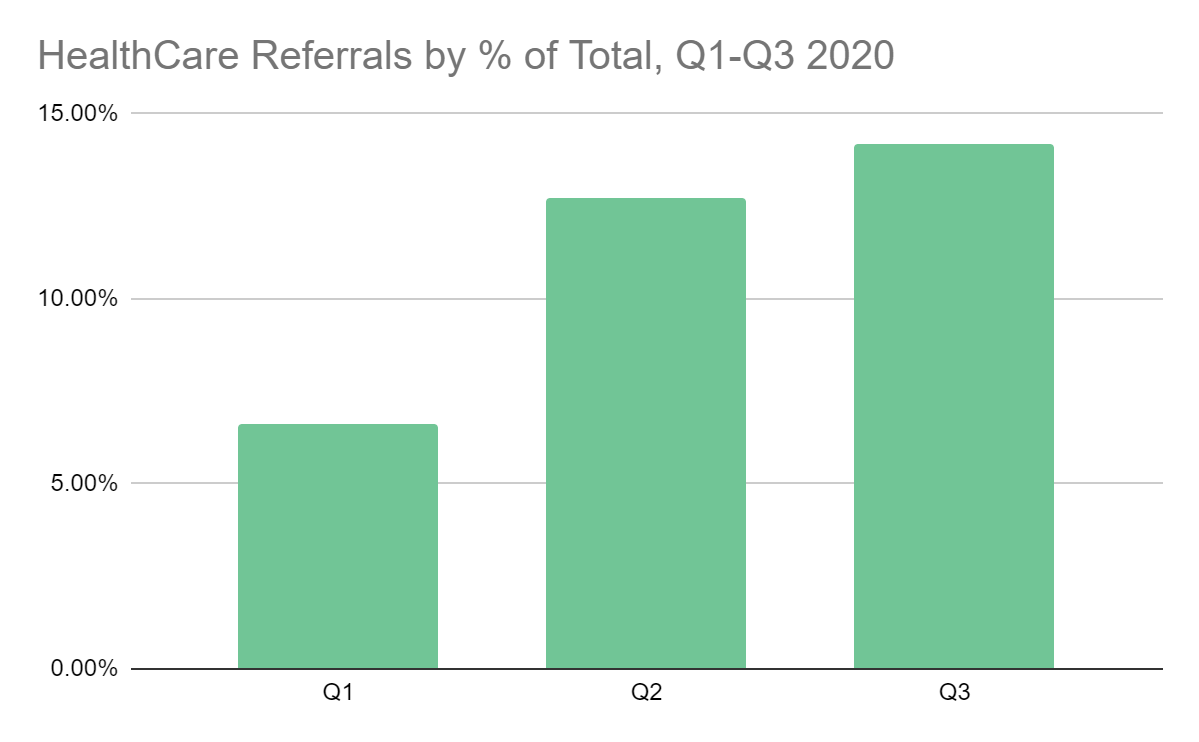

Here at SpringFour, we have seen first-hand how the COVID-19 pandemic has led to the increased need for additional healthcare savings resources for families. The charts below show the actual and percentage of total figures for healthcare-related referrals by quarter. These referrals include three categories: healthcare savings, health insurance assistance, and COVID-19 health (which is a category that SpringFour created in the weeks following the pandemic to cover COVID-19-specific healthcare needs).

What we see below is a numeric spike in demand for healthcare-related referrals during Q2, at the height of when many Americans were losing their jobs. At the same time, we are seeing a continuous increase in healthcare-related referrals as a percentage of our total referrals — this tells us that healthcare is taking over more space in the lives of people who are experiencing financial challenges. In Q3 2020, these referrals accounted for more than twice the percentage that they accounted for in Q1. This trend is unlikely to wane any time soon — and it might explode if policy changes occur in Q4.

While we are dedicated to helping in any way we can, SpringFour is also aware that the impending healthcare and health insurance crisis is one of epic proportions. While we work with our partners to provide assistance, we also recognize the devastating impact that a loss of health insurance will have on families, particularly in the middle of a pandemic. And as a person who is currently covered by the protections afforded under the ACA, I know I for one can relate to the fear that families have in losing access to care — right when I might need it most.

Katy Jacob

VP of Research & Impact, SpringFour

Awards and Recognition