10 Ways SpringFour Transformed Financial Health in 2024

1. Proved Financial Health is Here to Stay: SpringFour Acquired by C&R Software

This year was like no other because SpringFour was acquired by C&R Software. SpringFour continues to operate as a standalone brand with Rochelle Nawrocki Gorey remaining as CEO and the entire SpringFour team staying on board.

With C&R, we have access to operational support, an extensive network, and the opportunity to scale and bring SpringFour to many more organizations through C&R’s robust portfolio of clients, including new verticals such as utilities, telecom, government, and more.

What this news signifies most of all is this: financial health is here to stay. Together, we have changed perspectives, industries, and millions of lives — and now, the sky’s the limit.

This new chapter signifies an industry-defining moment, demonstrating that supporting consumer financial health is a competitive differentiator and sound business decision that results in win-wins.

“There’s a huge demand for financial guidance, but most people don’t know where to start — SpringFour steps in here, offering the tools and connections that help consumers find the support they need.”

2. Led the industry in providing best-in-class, vetted nonprofit and government resources to support financial health

SpringFour’s Resource Integrity Team continuously vetted local, statewide, and national financial health resources to help organizations provide trustworthy referrals that helped consumers through financial challenges. This is a huge value add for our clients — knowing they can trust the resources their customers access through SpringFour.

SpringFour will deliver more than 8 million referrals in 2024. This is more than a 45% increase over the 5.5 million referrals delivered in 2023.

This tells us our solutions are more in demand than ever. People need access to resources that can help them weather hardship and improve their financial health, and organizations trust SpringFour to help them deliver those resources.

SpringFour’s Resource Integrity Team of experts in social services, community development, and financial wellness reviewed 100% of all financial health resources available through SpringFour. The team added over 2,200 new resources focused on financial health areas such as affordable housing, health insurance, small business, and student loan counseling.

3. Launched S4connect, SpringFour’s new all-in-one, digital consumer self-serve tool

In 2024, SpringFour unveiled its latest product, S4connect, where consumers can self-serve to access financial health resources in a variety of categories.

S4connect gives people what they need and are craving from their organizations. We have the engagement rates to prove it: Clients have successfully deployed S4connect and have seen high engagement rates of 30-50%, exceeding industry standards.

4. Highlighted consumer need trends and how organizations that use SpringFour are delivering impact and increasing customer engagement

Financial health challenges not only hit bank accounts, they can also take a toll on physical and mental health. A survey by MarketWatch found that 41% of respondents agreed that finances were destroying their mental health.

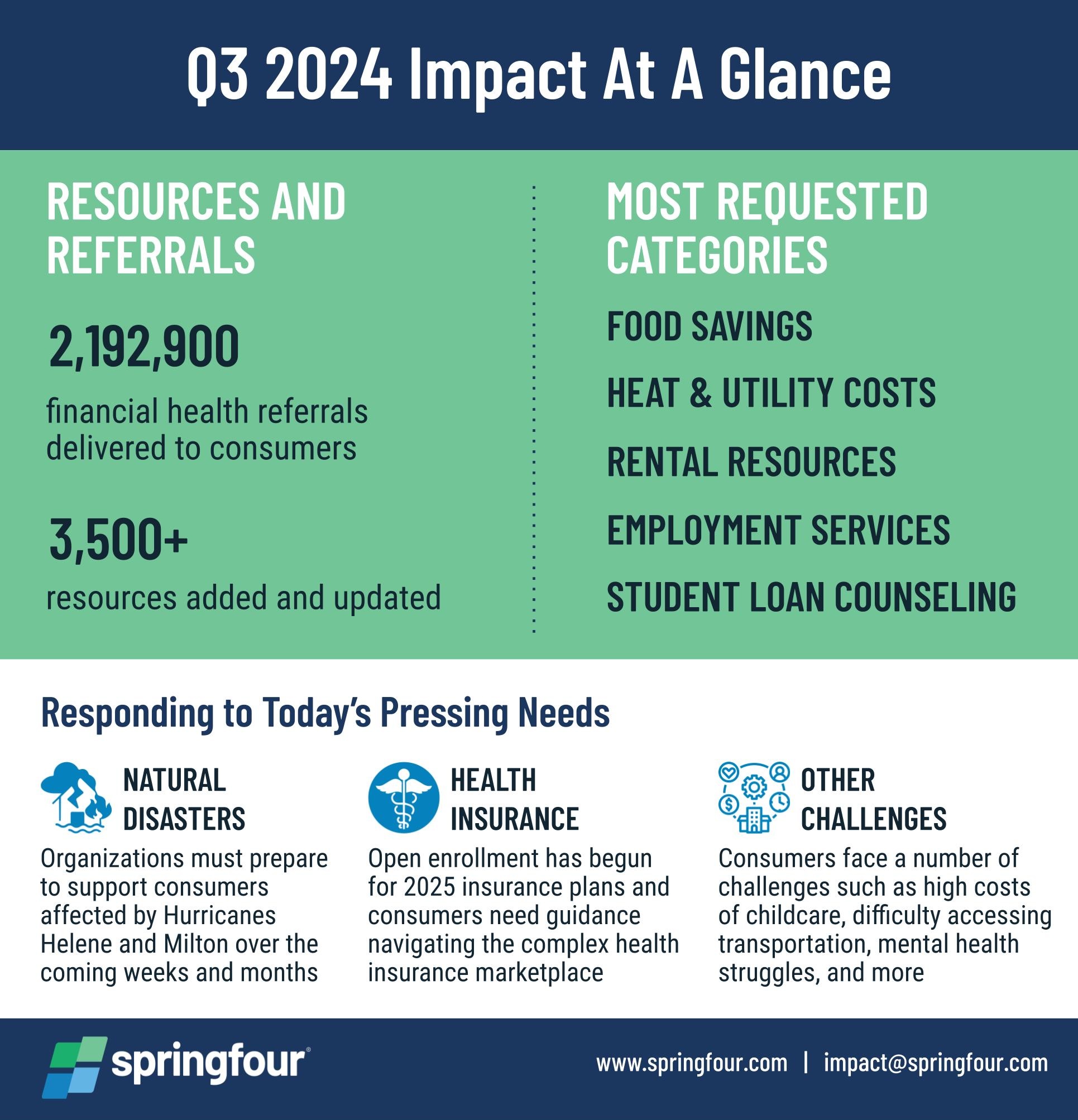

SpringFour delivered Quarterly and Annual Impact Reports highlighting industry and consumer trends each quarter as seen in the market and SpringFour’s usage data. We shed light on what consumers need at any given time and the financial state of today’s consumers to help organizations understand the challenges their consumers are facing and how they should respond to best support consumers’ financial health.

5. Shed light on essential, in-demand financial health categories and empowering organizations to help consumers access assistance

Click on a category below to learn more about how SpringFour delivered impact in each of these financial health categories throughout 2024.

6. Bolstered clients’ ESG & Social Impact results

Every year, SpringFour delivers Client ESG Reporting that helps organizations drive, measure, and report on the impact they’ve achieved in partnership with SpringFour.

SpringFour’s ESG Reports provide metrics based on each client’s use of their SpringFour product(s). Included in the Reports are key impact metrics such as:

By sharing this data in our Client ESG Reporting, organizations can better understand and support different segments of their market.

See how our clients featured their partnerships with SpringFour in their annual ESG, CSR, Annual, or Sustainability reporting this year. Read reports from BMO, Capital One, Fifth Third Bank, Flagstar, KeyBank, M&T, Oportun, and Patelco Credit Union to see how SpringFour helps these organizations drive financial health and social impact.

7. Built strong partnerships with top brands across a variety of industries

SpringFour and our clients BMO, Capital One, Fay Servicing, Fifth Third Bank, Financial Finesse, KeyBank, OppFi, Patelco Credit Union, and Self amplified our joint impact this year through press features, speaking engagements, and more.

Fifth Third Bank and SpringFour forged a new partnership in 2024, bringing SpringFour’s financial health resources to consumers in person through Fifth Third’s mobile banking experience, the eBus.

“At Fifth Third, we believe that lives are improved when people have the knowledge and tools to make wise financial decisions. With the eBus [which now provides SpringFour], we deliver financial tools and resources to communities that may not have easy access to such resources.”

Fifth Third Bank is a prime example of a company that’s leading the way in disaster recovery efforts, offering disaster relief and other resources by providing SpringFour’s S4connect to consumers visiting its eBus, which headed to Florida last month to provide much-needed financial resources to those impacted by Hurricane Milton.

“The bankers don’t have to think about all these questions that they need to ask the consumer, the consumer is really self-directing what they need at that particular time when they come to the bus.”

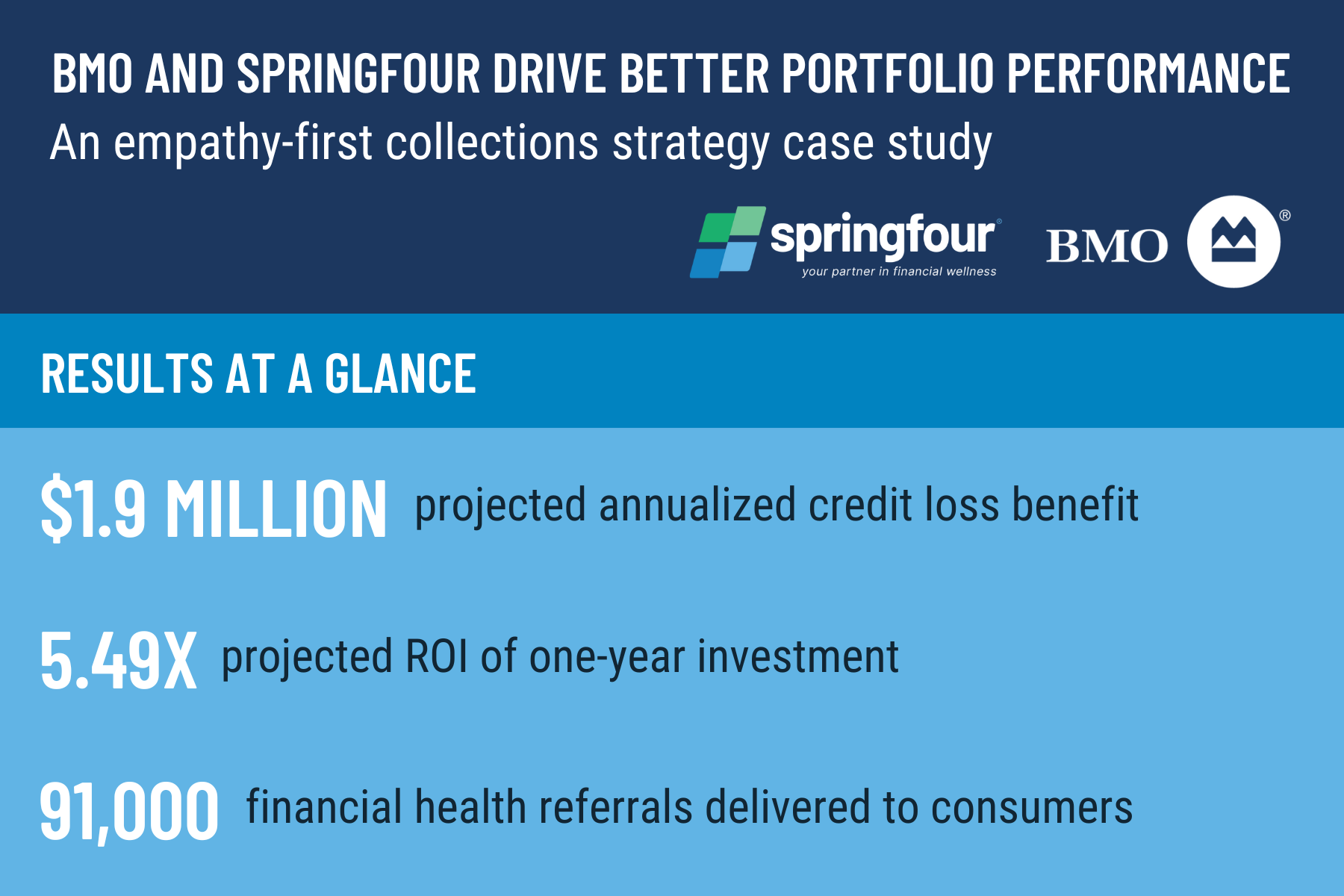

BMO and SpringFour drove significant win-win impact together in 2024.

This year, BMO and SpringFour conducted a case study titled “BMO and SpringFour Drive Better Portfolio Performance: An empathy-first collections strategy case study.”

SpringFour and BMO’s winning partnership was also highlighted in the press this year with features from The Financial Brand and Banking Transformed Podcast.

“When you go above and beyond to provide such services to clients, they become your clients for life… No marketing, no dollars can actually buy that kind of loyalty. And to me, that’s why this partnership and the tool and the solutions are so powerful.”

Additionally, BMO and SpringFour joined other SpringFour clients Capital One and KeyBank on a panel at Consumer Bankers’ Association Live 2024 to share how SpringFour has enabled them to support customers in default and account management strategies, nurture better customer engagement, and prioritize consumer financial health.

Self and SpringFour have worked together since 2019 to empower customers with self-serve access to SpringFour’s financial health resources via Self’s website and mobile app.

In nearly 5 years of partnership, Self Financial and SpringFour have delivered over 3,417,000 financial health referrals to more than 250,000 of Self’s customers.

Self and SpringFour’s impactful partnership has been included in multiple industry features including:

🔷 A panel at Financial Health Network’s EMERGE called “The Power of Partnerships” with other SpringFour clients OppFi and Patelco Credit Union

🔷 A Fintech is Femme article, “Fintech CEOs Team Up to Improve Financial Well-Being”

“At the core of what we do is really helping that customer and improving their financial future. SpringFour has a great capacity to do that beyond the kinds of things that we can do here at Self.”

8. Received incredible validation and feedback from our clients, users, and other industry connections proving that SpringFour delivers impact

SpringFour offers self-serve products that empower consumers to access resources 24/7 to find what they need. See what consumers have to say about SpringFour.

SpringFour offers contact center solutions that empower agents, counselors, and coaches to provide better customer service by delivering resources to consumers. Based on a 2024 survey, 98% of users agree they provide better customer service when using SpringFour. See what agents, coaches, and counselors have to say about SpringFour.

SpringFour partners with banks, credit unions, fintech lenders, employers, loan servicers, mortgage insurers, nonprofits, and organizations across all industries to drive win-win impact. See what our clients have to say about using SpringFour.

“We’ve gotten phone calls from people who are living in their cars. They are employed, but they are living in their cars. SpringFour empowers coaches to be able to put in a ZIP Code and it be able to immediately, out of over 23,000 different resources, get a curated list of resources within these 30+ categories. It is an amazing value. It empowers us. That’s what I really want to emphasize – as a coach, we have an amazing toolbox.“

“We’ve gotten phone calls from people who are living in their cars. They are employed, but they are living in their cars. SpringFour empowers coaches to be able to put in a ZIP Code and it be able to immediately, out of over 23,000 different resources, get a curated list of resources within these 30+ categories. It is an amazing value. It empowers us. That’s what I really want to emphasize – as a coach, we have an amazing toolbox.“

SpringFour’s win-win impact is often highlighted through various press and media features. See what the press is saying about SpringFour.

“By connecting consumers to vetted financial resources, [SpringFour] enables consumers to meet their financial objectives, reduce household expenses, and avoid payment delinquencies. It’s a win-win solution, and one that is much needed.”

“With SpringFour, agents are solving people’s problems as opposed to simply collecting people’s money… it impacts your employees as well as your customers in a positive heartwarming way.”

9. Kept the spotlight on women in fintech through award wins, judging opportunities, and mentorship

As a woman-founded and largely women-led company, we take every opportunity we can to participate in experiences to support and mentor women. Through award wins, sharing our expertise at startup events, and mentoring young women, SpringFour helps other women entrepreneurs succeed.

SpringFour was recognized this year for its integral role as a women-led fintech driving measurable impact with multiple industry awards.

Following the award win, SpringFour and Rochelle were spotlighted in American Banker, “Financial health professional: Rochelle Nawrocki Gorey.”

SpringFour’s Founder and CEO was named to American Banker’s 2024 Most Influential Women in Fintech! This award honors female leaders in the fintech community who are helping to bring new financial technology to life and move the industry forward in its efforts to help consumers, businesses, and financial institutions innovate to bring about better products and experiences.

The Most Influential Women in Fintech were recognized at American Banker’s Digital Banking Conference.

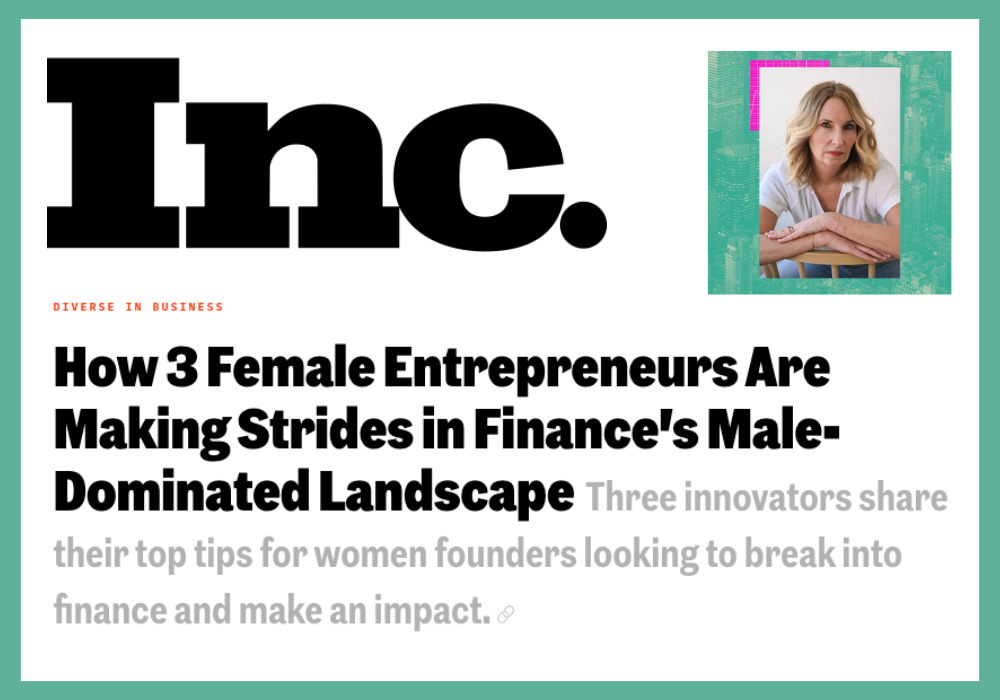

SpringFour Founder and CEO Rochelle Nawrocki Gorey also made Inc.’s Female Founders 250 — a list of the most creative and impactful female leaders in America!

Rochelle Nawrocki Gorey was chosen in both the financial services and changemaker categories, according to Inc., “for demonstrating the importance of marrying social impact with fintech and completing more than 5 million financial health referrals in 2023.”

This year, SpringFour’s Rochelle Nawrocki Gorey was featured alongside founders Christina Aguilera, Selena Gomez, Scarlett Johannson, Katy Perry, Shay Mitchell, and Natalie Portman, as well as Financial Industry leaders Billie Jean King of Billie Jean King Enterprises and Wendy Cai-Lee at Piermont Bank.

“The past year, for many, will go down as one of the hardest ever — between a funding freeze and ad-spending pull back. The female founders on this year’s list are a testament to what triumph over adversity looks like. They should all be proud of this singular accomplishment.”

Inc. also featured Rochelle Nawrocki Gorey as an industry-leading female entrepreneur and SpringFour’s winning product-market fit in “How 3 Female Entrepreneurs Are Making Strides in Finance’s Male-Dominated Landscape.”

The article highlights that “intentional growth” has been core to SpringFour’s lasting success in the financial services industry.

Rochelle Nawrocki Gorey was also selected for Purpose Jobs’ Women in Tech award.

“A trusted expert, thought leader, and innovator, Gorey is revolutionizing the way the financial industry responds to consumers experiencing hardships by improving customer outcomes while driving impact for organizations and their bottom lines.”

Our CEO and Founder visited her alma mater, Michigan State University (MSU), to share her founder’s story and SpringFour’s mission with the fintech and insure tech startups participating in MSU’s Conquer Accelerator program.

Student founders from the Momentum Pre-Accelerator at MSU’s Burgess Institute for Entrepreneurship & Innovation came to Chicago for several days of activities and interactions with entrepreneurs, investors, and MSU alumni. Rochelle attended a dinner as an MSU alumna to answer questions from the student founders.

Another opportunity we took to mentor students this year was participating as a judge for Northwestern University’s VentureCat 2024 competition in the Social Impact track.

Rochelle enjoyed providing insights alongside executives from Flowers for Dreams, The Ruthless for Good Fund, Builders Vision, and Health Equity Innovation Partners.

10. Explored what impact means to us and demonstrated that impact in action

Impact is always a top priority at SpringFour. We consider impact in all aspects of our business and remain focused on delivering impactful results to our clients, their customers, their employees, and their bottom lines.

“By connecting consumers to vetted financial resources, [SpringFour] enables consumers to meet their financial objectives, reduce household expenses, and avoid payment delinquencies. It’s a win-win solution, and one that is much needed.”

SpringFour won Real Leaders’ 2024 Top Impact Companies. Real Leaders celebrates Top Impact Companies striving to build a better world and scale solutions that address pressing issues around the globe.

As social impact has always been the cornerstone of our business, we’re honored to be featured at #26 on this list for the financial services category.

Following the award win, Rochelle joined the Real Leaders podcast with Kevin Edwards. On the podcast, Rochelle was asked, “How do you define the word ‘impact’?”

Here’s what she had to say about what impact means to us at SpringFour:

“Progress. Results. Seeing something different occur. To me, that is impact in a really tangible way…And I’ll give you an example. We were on a call with one of our clients and they were able to gather feedback from their customers from their SpringFour digital experience. Somebody thanked them and said not only that they got food assistance, but that they were able to secure a better job. Now let that sink in for a moment. Somebody got a better paying job because they were able to use technology made available through their credit card company, and were able to connect with a nonprofit, most likely right in their own neighborhood, and got a better paying job. To me, that’s impact.”

SpringFour was also featured on the One Vision fintech fuse podcast with Theodora Lau on an episode titled “Impact as a differentiator in the financial services industry.”

“We’ve gotten phone calls from people who are living in their cars. They are employed, but they are living in their cars. SpringFour empowers coaches to be able to put in a ZIP Code and it be able to immediately, out of over 23,000 different resources, get a curated list of resources within these 30+ categories. It is an amazing value. It empowers us. That’s what I really want to emphasize – as a coach, we have an amazing toolbox.“

Made friends along the way

Thank you for joining the financial health movement with us at SpringFour. We’ve had a jam-packed year, and we’re incredibly proud to have driven so much impact in partnership with banks, credit unions, fintech lenders, employers, loan servicers, mortgage insurers, nonprofits, and organizations across all industries.

If you’re not already driving impact in partnership with SpringFour — now is the time. It takes 30 days or less and little IT and marketing support to deploy our solutions.

Consumers will be facing financial challenges in 2025. Prioritize financial health now to support your consumers as they need more support next year and beyond.

We’re proud to be part of the solution. You should be, too. Come join us.

Morgan Pierce

Impact and Communications Manager, SpringFour

Awards and Recognition