I’m an amateur baker, which means I have way too many ingredients in my pantry and probably too many cookbooks. When I find a recipe that I like, I just can’t resist making it again and again until it’s perfect (and since it’s dessert my family doesn’t complain). I like to share my recipes with anyone who is interested because I believe that we can all benefit from a good meal.

I’m also a financial technology professional and the VP of Data Integrity at SpringFour. SpringFour’s award winning solutions inspire me to work everyday to ensure that the resources our customers access are the very best possible. So in the spirit of recipe sharing, I’m going to outline the four key ingredients that make up SpringFour’s data integrity strategy and insure that we are delivering the best data possible to our clients.

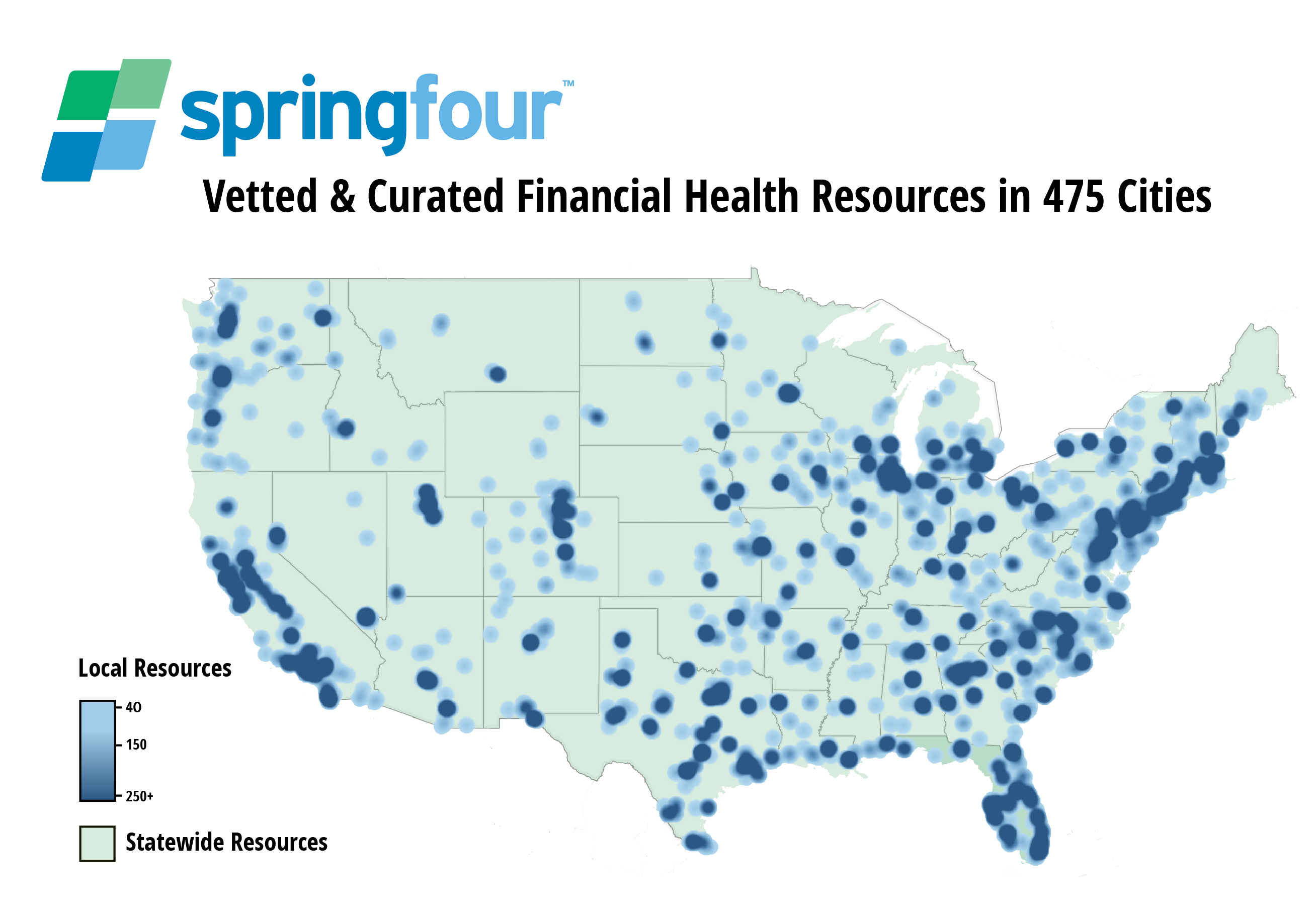

It’s no secret that we like the number four. SpringFour’s FOUR guiding principles: connections, impact, integrity and savings are informed by our mission to connect consumers to the financial health resources they need. Our executive team of FOUR committed go-getters and do-gooders, has been recognized by our partners and the industry, including large financial institutions and innovative FinTechs, for excellent relationship management, forward thinking, commitment and innovation in the field of financial health.

So what’s the winning recipe?

Step 1: Professionally Vetted

In the age of AI and advanced technology many people are surprised to learn that SpringFour resources are updated manually. Each listing is reviewed by a trained human eye at least 3 times before being seen by a consumer.

Web scraping, the process of importing information from a website into your own files or spreadsheets, is used by many other referral systems as the source of the information they provide to their customers. We don’t do it, ever. Ethical concerns aside, those of us that work with data in the realm of public policy know that there is no perfect tool for evaluating the complexity of a nonprofit and government program offering. A computer can not look at a list of services or even a list of phone numbers and decide which would be the most useful to a person struggling with a number of financial challenges.

Instead, we rely on the eyes and experience of talented people who review each resource for suitability and accuracy. Our Resource Integrity Team includes quality control specialists and research analysts with years of experience in housing, community development, social services, community health, education, and small business development. Our team of nonprofit and business professionals have graduate degrees, serve on nonprofit boards, and volunteer in their community.

Our passionate team is motivated by the impact their meticulous work has on hundreds of thousands of people who receive SpringFour referrals each year.

“It’s amazing to work for a fintech company that is focused on a mission to help those that are less fortunate. Through the training process I learned about the sheer number of resources that SpringFour provides to those that are down on their luck. Everything from utility assistance, to immigration support, to paying for medication. And there are numerous resources across several categories in every state. Each listing provides all of the information you need to make a call or visit a location to take advantage of those services. It really is a game changer and I’m so excited to be a part of the team.”

Jessica Williams, Resource Integrity Specialist, SpringFour

Step 2: Curated

Not only is our information vetted but it is also heavily curated. According to the National Center of Charitable Statistics, there are 1.5 million nonprofit organizations in the U.S. In New York City alone there are close to 100,000 nonprofit agencies, meaning it would take a New Yorker about 30 years to call every agency to find help.

People in financial crisis are already overwhelmed. A survey last year found that 85% of Americans are stressed about money. For those that turn to the internet for help, the sheer amount of information can result in a feeling of powerlessness and confusion. A person searching Google for “help with debt” will see 500 million results, many of which are unscrupulous actors that may wish to take advantage of a desperate situation.

Similarly, call center agents and counselors looking to help their customers don’t have the extra time it takes to sift through most referral websites. Agents that are juggling back-to-back calls, pulling up financial information and listening to customer concerns, need to find relevant information that can be reviewed and delivered in a matter of seconds.

Our goal at SpringFour is not to list everything available, but to list the very best resources available at the local and national level, for each particular financial challenge.

Step 3: Unbiased

Our revenue model allows our data integrity team to be completely unbiased in their work. Other applications in the hands of consumers charge a “referral fee” to organizations and companies who wish to be listed or earn affiliate fees for the products or services that are “recommended”. SpringFour never charges the organizations listed in our database or accepts any kind of self-reported information. Any information that comes through our doors is always vetted and evaluated by our professional data team.

“It’s great to have a service like this that provides unbiased referrals to non-profit and government services because we never have to question the authenticity of the information we’re passing on to our clients in need”.

-Non-profit Counselor

Step 4: Quality

The talent of our professional data team combined with our processes for vetting and curating contributes to a resource quality that is unmatched in our industry. The protocols for updating our proprietary database meets or exceeds Information & Referral (211) Quality Assurance Standards. Our own quality standards are outlined and reviewed bi-annually.

We’ve been perfecting this strategy since 2005 to bring our users and their customers resources they can trust.

So if you’ve ever tasted a perfectly crafted tart or pie crust (here’s my favorite recipe by the way), you’ve benefited from a pastry chef who knows the benefit of following a strict process and taking the extra time to get it right. I believe we should expect the same from our data, especially when people’s financial health is at risk.

Are you hungry for trusted resources? Want to find out more about how you can leverage our vetted and curated quality resources and easy-to-use platform to help your customers? Get in touch.

Recent Comments